Posts by crackerjack

5 Investment Patterns That Don’t Make Sense

2015 is shaping up to be a challenging year for investments. The market swoon in mid-August caught most off-guard, and the subsequent violent recovery arrived right after several prominent investors turned bearish, or at least hedged. Markets don’t need to make any sense, and at times, understanding “why” the market is getting crushed, or exploding,…

Read MoreDovish Fed Minutes Ramp Market; Valuing the Yellen Put

The September 16-17th FOMC minutes were released Thursday afternoon, continuing the market’s Beast Mode reaction to Fed dovishness. The S&P 500 completed the best week of the year, barely down-ticking from 1,893 to 2,015. The market rallied 7% from the lows after the September Employment report to the highs yesterday. The 122 handle rally takes the…

Read MoreUtilities Utilities Utilities; sound investment for a slower growth, low rate world

What a rally! In two sessions, the S&P 500 rallied 5%, almost 100 handles from the Friday low. The ex-post “cause” of the rally seems to be the punk September Employment Report, which boxes the Fed into a corner. Yellen’s inertia, and dovishness, during the September press conference, coupled with the subsequent soft employment data,…

Read MoreGlobal Growth Scare + High Valuations = Bear Market Dynamics

It’s been a difficult market since the dog days of summer. After 10-months of exceptionally low volatility, a fierce downdraft set in during mid-August. Lower stock prices, and volatility, will persist, simply because the conditions to go right back to the old dynamic aren’t in place. There isn’t enough global growth to support stock prices…

Read MoreNike Bone Crusher; China’s Economy isn’t Collapsing

Maybe the economy in China isn’t collapsing. Nike reported a bone crusher of a quarterly report last night; a stark wake-up call for China bears. Nike management credibility is higher than that of the Chinese government, and this earnings report, at this juncture, is stunningly good. Nike segment reports its future orders by geography, adjusted…

Read MorePrimark is Coming; US Specialty Apparel Sector Disrupted

Business models that don’t evolve are always threatened by disruption. The US specialty apparel sector is a fascinating case study in businesses, and brands, entrenched for long periods of time (decades), seemingly safe, but now facing imminent destruction. The concept of the shopping mall is dated; millennials have different habits than teens in the 80s…

Read MoreSuper Dovish Fed Persists

The Fed’s lack of policy response, and subsequent press conference, evokes memories of a scene in Bronx Tale… What’s going on here? Now you can’t leave. I will never forget the look on their faces. All eight of them.Their faces dropped. All their courage and strength was drained from their bodies. They had a reputation for breaking up…

Read MoreBrazil’s Economic Miracle; Seeing the Monster

The depth of corruption and scandal at Petroleo Brasileiro (Petrobras) isn’t your typical run of the mill emerging market scam. A conflux of events around the world, built up over decades, fostered the conditions for a defrauding of this magnitude. Post financial crisis, global central bank stimulus, created an environment devoid of scrutiny, resulting in…

Read MoreEmployment Report & Markets; Forcing a Fed Rate Hike

While the odds on a Fed rate hike are still vacillating, the strong jobs report, and recent market action are now forcing the Fed’s hand. The Fed needs extreme market conditions to justify not hiking. The point has arrived where stock and bond markets are strong enough, even with the prospects of a hike, that diminished Fed credibility should…

Read MoreChina Central Bank Governor, Zhou Xiaochuan; China Bubble has Burst

News out of China is opaque; often altered, editorialized, or outright censored. It is rare to receive a straightforward assessment, based in fact, irrespective of the congruence with the China governmental aims. Zhou Xiaochuan (ZX) is a maverick Central Bank governor, versed in global economics, and financial markets. ZX is a reformer, pushing to open…

Read MoreChina in Recession; Yuan Depreciation Imminent

China is at the end-game of its great economic transformation. Multiple iterations of 5-year plans, and flawed central economic planning, created a massive build-up in debt that can no longer be continued. China’s debt fueled growth is understood, but the impact of the deleveraging phase is becoming evident in real time. Various estimates of China…

Read MoreCrude Rally Boxes Fed Into A Corner & China PMI Weakest Since 2012

This weekend’s Jackson Hole speeches, and subsequent commentary, outlined the guideposts for a Fed rate hike, potentially in September. The explosion in crude, if it holds for two more weeks, will pressure the Fed to hike. The Fed clearly highlighted the USD, employment, and oil, as drivers of inflation. The fast 10-point in rally in oil, from sub-$40,…

Read MoreStanley Fischer’s Jackson Hole Speech: Fed Determined to Lift-Off

Stanley Fischer delivered a critical speech this weekend at the Jackson Hole, Economic Symposium, outlining the Fed’s forward looking view on inflation and the potential for a lessening of factors that dampen inflation. This speech signals the Fed is staying the course and determined for rate hike lift-off on the advertised time-table. CJF interprets this…

Read MoreEmerging Market Doldrums

Not out of the woods yet – no way. The world has changed in the past week, and unmistakably, extreme volatility (mostly of the down kind) is back within financial markets. The potential of Fed rate hike cycle, in the not too distant future, is wreaking havoc. An unintended consequences of the extended period of…

Read MoreMarket Treads Water

After a one year hiatus (CJF writing hiatus), the US equity market remains resilient, hovering around 2,100, in a historically tight range for the past 9-months. The 20-day, 50-day, 100-day, and now 200-day, moving averages are converging, because again, the market is flat. A few observations to re-engage investment dialogue on this blog… At risk…

Read MoreS&P2K; a new highs odyssey

Please excuse the summer lull – anticipating more regular posts after a well needed period of summer travel! Two posts ago (in late May) focused on the market ascent to 1,900. In relatively short order, another centennial milestone is surpassed with the market melt-up to 2,000 over the past 15 trading days. Recapping the market…

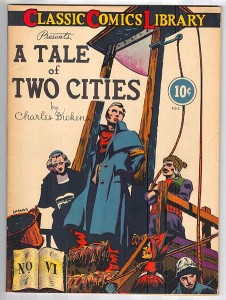

Read MoreA tale of two growth rates; GDP and US corporate profits

Last week’s “second” 1Q14 GDP print revised to a -1.0% annualized growth rate relative to the prior print of +0.1%. The second 1Q14 GDP print was shrugged off, with equity markets rallying to new highs, in impressive fashion, given the seasonally low volumes around Memorial Day. While the 1Q14 print is still not “final” (there…

Read More