Archive for January 2012

Global Demographics – An Important Multi-Year Investment Theme

With much fanfare, estimates of the earth’s population recently surpassed 7 billion people. Population growth rates have been staggering for decades, for a number of reasons. The straightforward explanation is that global birth rates have remained high while there has been tremendous improvement in child mortality rates and life expectancy. Sewer system implementation in the…

Read MoreInvestment Themes for Q4 Earnings Season

Fourth quarter earnings season is upon us while the market is off to a torrid start to the year. While the S&P 500 is up 4% year-to-date, there are a number of riskier indexes and sectors doing considerably better. The NASDAQ is up 6.3%, the Russell 2000 5.2%, the Hang Seng 7.6%, the Brazilian BOVESPA…

Read MoreInflation in Europe is Sticky – Another Reason the ECB to Remain Balanced

December inflation data was released this morning in France and Germany. In both countries, the inflation rate was higher than expected and failed to come down relative to prior months. EU harmonized German inflation was reported at 2.3% and EU harmonized French inflation was 2.7%. Two large economies yet to report inflation data are Spain…

Read MorePhilippine Central Bank – Another Emerging Market Set to Ease Monetary Policy in the First Quarter

The Philippines is a very large nation that is off the radar of most mainstream economic analysis. The country has a population of 93 million, and the economy has enormous potential but exhibits inconsistent growth. The economy of the Philippines has a decently developed electronics/semiconductor industry and a large export industry for fruits, palm oil,…

Read MoreNegative German Yields – Implications for Risk Averse Financial Markets

On Monday, Germany gained entrance to a rarified club of sovereign nations paid to borrow money. This US accomplished this feat during the depths of the financial crisis. Now Germany is able to achieve the same feat during the Eurozone sovereign debt crisis. In a debt auction on Monday, Germany was able to sell 3.9B…

Read MoreOn Paranormal – A Review of the “New-New Normal”

PARANORMAL: beyond the range of normal experience or scientific explanation, not in accordance with scientific laws. A great friend of mine, and incredibly savvy investor, recently pointed me to Bill Gross’ January 2012 Investment Outlook: “Towards the Paranormal”. He suggested it was an intriguing, provocative, and worthwhile read. After reading the four page monthly I…

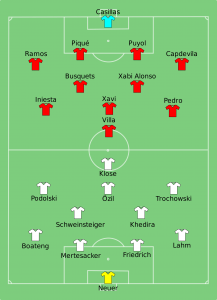

Read MoreSpain & Germany – In Sickness and in Health

The plan forward with the Eurozone crisis is the German plan forward. Germany proposed closer fiscal union and increased austerity for EU-17 nations with high deficits and/or high debt burdens. This path suits German interests well because there is little that needs to be changed. Unfortunately from Spain’s standpoint, the German path forward is not…

Read More2012 Global Investment Themes and Predictions

In 2011, the stock market experienced some dramatic swings, heightened volatility, managed some months of tremendous strength and sickening weakness. After an exhausting ride, the S&P 500 index returned to precisely where it started. For those who appreciate extreme precision, the market was down on the year based on the second decimal point of the…

Read More