Archive for April 2014

Energizer Bunny gets a boost; how ENR’s split-up creates immediate shareholder value

Energizer (ENR) stock is up 15% this morning based on a corporate action that is long overdue; the company is splitting itself into two separate and distinct public companies. Energizer contains products within two segments; household products (batteries) and personal care (razors, shaving, skin care, feminine care). Going forward, the stock will be split into…

Read MoreWealth Effect; gaining steam from asset returns and persistence

The ongoing economic tug-of-war remains tied. Growth spurts with better momentum (housing, auto, healthy corporate profits, job market) are almost immediately met by numerous automatic stabilizers (higher mortgage rates, deteriorating housing affordability, satiation of replacement cycles). But weighing the good and the bad, we are in a fine environment for the stock market. The environment…

Read MoreBoeing at cruising altitude; the world needs more planes!

Boeing’s investment performance has been spectacular since the announcement, and subsequent investigations of battery fires in late 2012. The stock price marched from $70 to $140, achieving a rapid 16-month double. The opportunity in late 2012/early 2013 was outsized; it is rare to purchase a company as dominant as Boeing, in the early stages of…

Read MoreStudent debt bubble; should school loans be repaid, or not?

Tuesday’s WSJ presented an interesting cover story on student debt forgiveness. Push back is growing with respect to managing the amount of total debt forgiveness or capping it to a maximum amount; the article states $57,500 as potential forgiveness cap per student. Bubble aftermath is never pretty and the fascinating case of runaway US student…

Read MoreGoogle is getting cheaper; valuation attractive after consistent growth and stock pullback

Google continues to roll. The share price will zig and zag but the company is making strides by investing for growth and positioning for better results in the future. Current results are still quite respectable today and earnings and cash flow growth are catching up to the stock price. The GOOG investment theme has been…

Read MoreRisk-reduction driven market corrections are healthy; this one presents opportunities

The pullback in the market should not be a surprise. The real surprise is the extent of the market’s ascent over the past 18-months, without a single significant draw-down. Corrections are normal during the course of a bull market, and aid in accomplishing a number of items: building the wall of worry; an important source…

Read MoreAlcoa is “reinventing the wheel” – potential to be a big multi-year investment theme

Back-to-back posts on Alcoa (AA) to follow up on a powerful investment theme with the potential for outsized returns over several years. There is a time and a place for each individual stock investment, and the proper synchronicity is all the more important for out-of-favor / out-of-consensus investment themes like Alcoa. The classic elements for…

Read MoreAlcoa (AA); well positioned and stock worth revisiting

Alcoa (AA) just hasn’t received respect over the past several years. This is in the process of changing today, and AA has the potential to continue its rally to the low $20s from $12-$13. AA morphed into a classic out-of –favor stock since the financial crisis but lackluster stock performance created value amidst horrible sentiment.…

Read MoreEarnings preview for a bull market; what to expect for 1Q14

1Q14 earnings will begin in earnest by mid-April with the market flirting with new highs over the past several sessions. Geopolitical concerns, and Fed taper fears, are gradually fading into the background, and investors are in for a period of individual earnings results driving stocks, and ultimately, market performance. The setup for 1Q is unique;…

Read MoreTime to go global with hydraulic fracturing investments

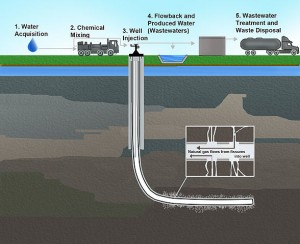

Ukraine is dependent on Russian energy sources; an unsustainable co-dependence, which is now set to change. In fact, Europe, more focused on green initiatives, is woefully behind the US with respect to energy independence. Putting aside the environmental arguments, geopolitical events have a way of focusing policy actions, and just this past week, there has…

Read More