Economics

On the phase one China Trade Deal

In an unseemly signing ceremony, with a plethora of US CEOs and government officials, 3-4 dignitaries from China, and much bravado from President Trump, the Phase One US-China trade deal was signed and presented to the world. Markets cheered. Aside from the spectacle of it all, there is some cause for short-term optimism over a…

Read MoreThe Powell Put is Struck Lower

In spectacular fashion, over the past few weeks, stark reminders emerged on how fast confidence unravels in the midst of a slowdown, particularly so, when the slowdown is doused with policy response errors. A conflux of negatives compounded to send US financial markets into bear market territory, ultimately, calling into question the economic expansion since…

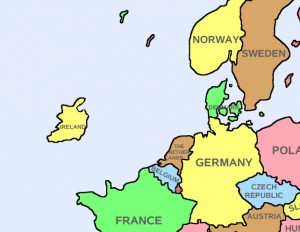

Read MorePounded; BREXIT Risks Hit Markets

In a low volatility, range bound market, it doesn’t take much to cause a break. Rising global bonds yields are a major concern that double-impact the market; higher future business costs of funding growth, financing acquisitions, and implementing share repurchases, while, in tandem, high equity valuations are pressured. Now the market has another major worry.…

Read MoreYellen Fed & Monetary Policy: “Running it Hot”

The September Fed meeting issued few surprises; fed funds were not hiked, as was telegraphed by the Brainard speech. While the Fed maintained interest rates, in the press conference, Yellen once again, found a way to interject incremental dovishness, driving interest rates lower, and asset prices up. The playbook of the Yellen Fed for the…

Read MoreBig in Japan; Can the Fed trump the BOJ?

VIX back to the 15 range ahead of a consequential Fed meeting, deep into the economic cycle. Volatility crush continues into actual central bank announcements. Zombie US markets can’t go down but can’t rally either. After recent, underwhelming ECB announcements, markets sense more to come from the Fed, yet a gasping sense reigns omnipresent. What, actually, can…

Read MoreInmates Running the Asylum; Fed Policy 8-years into Recovery

Last week, a Fed Governor, made comments hitting Bloomberg, that the Fed was not a handmaiden to the markets. The comments, not part of a major speech, and difficult to find on Google, were striking, and provocative, conjuring memories of a period when this would never need to be said. Today’s baffling Fed communication strategy…

Read MoreVolatility Suppression Challenged

Since the BREXIT rebound/rip, it’s been an exceptionally stable summer. Few predicted that the unexpected BREXIT vote, would be an unequivocal positive to markets. The tell, quite clear after the fact, was the global rate plunge, and the US 10-year yield sinking to the 1.35% range, around the 4th of July. The perfect combination arose…

Read MoreOn Brexit

What a tumultuous 5 days. The lurching feeling is all the more acute after a period of one-way markets (up) and declining volatility. With polls shifting towards “Remain” last week, the prospect of all-time highs in the S&P 500 held an aura of inevitability. The unexpected Brexit vote, by a solid 4 point margin, tanked…

Read MoreValuing the Yellen Put

The Yellen Put, follows a line of Federal Reserve inspired put options, valuable to market participants of specific Fed Chair eras. The rationale behind the Fed Chair put is simple; with the Federal Reserve so vigilant to support any downtick in the economy and/or markets with interest rate cuts (Greenspan), quantitative easing (Bernanke), and ZIRF…

Read MoreChina Slowdown Will Plague Markets For Years

What a start to the year. CJF’s contrarian prediction of 1,860 on the S&P came to be on January 20th. Subsequently, the market rallied strongly on the hint of more quantitative easing out of the ECB, and the adoption of negative interest rates by the Bank of Japan. Any doubts that 2016 will be a…

Read MoreThe Fed Awakens; Creates Negative Global Market Backdrop

At the widely anticipated December 16th Fed meeting, the Board of Governors did the expected, and finally raised the US federal funds rate by 25 basis points. The rate-hike failed to surprise markets; the move was telegraphed and written about in advance by Jon Hilsenrath in an article on the front page of the Wall…

Read MoreISM sinks to post-2009 lows; Industrial Economy Recession a Catch 22 for Fed

November ISM sank to the lowest level since 2009. Stunning, that the ISM (Institute for Supply Chain Management) survey, formerly known as NAPM (National Association of Purchasing Managers), printed 48.6, the lowest level since the throes of the financial crisis. For perspective, the last time the ISM printed sub-48, in June 2009, the S&P was 900. Today,…

Read MoreQui n’avance pas, recule

We all eat at restaurants, go to stadiums, and walk down the street. The tragically successful terrorist attacks in Paris highlight the vulnerability of the human condition at any instant. While this has always been the case, and will continue to be so, civilization, and human progress, over past centuries and decades, reduces the chance…

Read MoreMidsummer Issues Persist; Divergent Global Central Bank Actions Create Challenges

The market moves fast. Thankfully, in the rest of the world, trends of all kinds, generally move at a measured pace. The market overreacts to events and day-to-day happenings based on crowd think and behavioral issues. A change in trend will often start with a subtle data point or indicator, which in hindsight, ignites a…

Read MoreDovish Fed Minutes Ramp Market; Valuing the Yellen Put

The September 16-17th FOMC minutes were released Thursday afternoon, continuing the market’s Beast Mode reaction to Fed dovishness. The S&P 500 completed the best week of the year, barely down-ticking from 1,893 to 2,015. The market rallied 7% from the lows after the September Employment report to the highs yesterday. The 122 handle rally takes the…

Read MoreSuper Dovish Fed Persists

The Fed’s lack of policy response, and subsequent press conference, evokes memories of a scene in Bronx Tale… What’s going on here? Now you can’t leave. I will never forget the look on their faces. All eight of them.Their faces dropped. All their courage and strength was drained from their bodies. They had a reputation for breaking up…

Read MoreEmployment Report & Markets; Forcing a Fed Rate Hike

While the odds on a Fed rate hike are still vacillating, the strong jobs report, and recent market action are now forcing the Fed’s hand. The Fed needs extreme market conditions to justify not hiking. The point has arrived where stock and bond markets are strong enough, even with the prospects of a hike, that diminished Fed credibility should…

Read More