Archive for August 2011

It’s Time to Buy in Hong Kong

After a brutal correction in both prices and valuations it is time to get long(er) China geared Hong Kong listed equities. I believe the timing is right because the single largest risk factor, inflationary pressure, is in the process of peaking, and is likely to abate moving forward. China growth persists at a 9% clip…

Read MoreRedbook Chain Store Sales Remain Strong – Don’t Indicate Slowdown

There has been considerable airplay relating to the “near recessionary” levels of many economic indicators in August. Readings for consumer confidence, economic optimism, and Fed Surveys from Philadelphia, New York, and Richmond have all contracted. These items have led many economists and forecasters to predict a sharp downturn in ISM (released Thursday), and have led…

Read MoreGreek Stock Market Surges on M&A

The Greek stock market is having a melt-up this morning, with the largest gains in 20-years. The index as a whole is up 14%, which isn’t bad for those who managed to get long Greek equities on Friday. And for more adventurous and daring sorts, the Cypriot stock market is up 18.5% this morning; Cyprus is leveraged…

Read MoreMother Nature vs NYC: Winner by KO – NYC

Shortly after 10:00am, everything started to clear up in NYC. I went for another run, like I did yesterday right before the storm hit. It looks like there will be virtually no major damage save for areas very close to NY Harbor downtown. I would be shocked if the New York Stock Exchange doesn’t open…

Read MoreCome on Irene – I Swear, Well He Means, At This Moment You Mean Everything

Ok – I know these lyrics are for “Eileen” and not “Irene” but the names sound similar and many confuse the name of the one hit wonder from Dexy’s Midnight Runners anyhow. This morning I woke up in downtown Manhattan and things were very much normal, the calm before the storm i suppose. From an…

Read MoreBen Bernanke’s Jackson Hole Speech: A Step In The Right Direction

I just read Ben Bernanke’s speech at Jackson Hole, and think it is one of the better speeches he has done in some time. I read some acknowledgement that there is little more the Fed can actually do to improve the US economy. This is of course true. Bernanke realizes he can only create an…

Read MoreBernanke’s Jackson Hole Speech: Market Could Close at 1,100 or 1,200 Today

The market remains destabilized which is quantified by the VIX index stubbornly remaining in the 40 vicinity. As long as the VIX remains in the 30-40 range investor should expect to see 2-3% moves both up and down in the market from these levels. I believe that the propensity for violent up moves is as…

Read MoreGuess (GES) – Q2 Results Fine, Exceptional Opportunity

Guess – Q2 Earnings 8/25/11 Guess (GES) reported Q2 earnings last night after the close with results at the higher-end of the company plan coming into the quarter. The knee jerk reaction in the after-hours was a selloff in the shares. Guess is one of the consumer sector’s best positioned companies and any weakness in…

Read MoreOhayou Gozaimasu! Moody’s Downgrades Japan

Moody’s came out today and downgraded Japan’s Sovereign Credit Rating from Aa2 to Aa3 based on the size of its deficit and large buildup of government debt. As a result of this downgrade, a number of Japanese banks and insurance companies will be downgraded by Moody’s as well. This news will make much less of…

Read MoreGoogle (GOOG) – A Focused Internet Giant

Google (GOOG) was highlighted in a post we did after the announcement to acquire Motorola on 8/15/11. In actuality, Google has the opportunity to produce 20-30% stock price returns for a number of years as investors today are buying into the stock at the ex-financial crisis low valuation. We break down Google into the following…

Read MoreChicago Fed Index – a “Not in Recession” data point

This morning, the Chicago Fed National Activity Index came out “better than expected” for the month of July. This measure is released with a bit of a lag and is one of the last July data points to be released. The measure is comprehensive and incorporates national activity relating to inflation, employment, consumption, and housing. So…

Read MoreHere’s how it’s different this time

How is 2011 different than 2008? As the financial press quotes “investment professionals” each and every morning on the front page of the WSJ or the TOP bloomberg story with mention of how dire the market and economic situation is, and how there are many similarities to the feel of 2008 – I thought it…

Read MoreDown 419 but a surge higher at the close

From 3:45pm, in today’s darkest hour (for the market) when the S&P was bang on the lows, we saw a glimmer of hope with a fast 135 point DOW rally in literally 8 minutes. Calling a spade a spade, the market was soundly clobbered today. But this is not a “financial crisis” or a market…

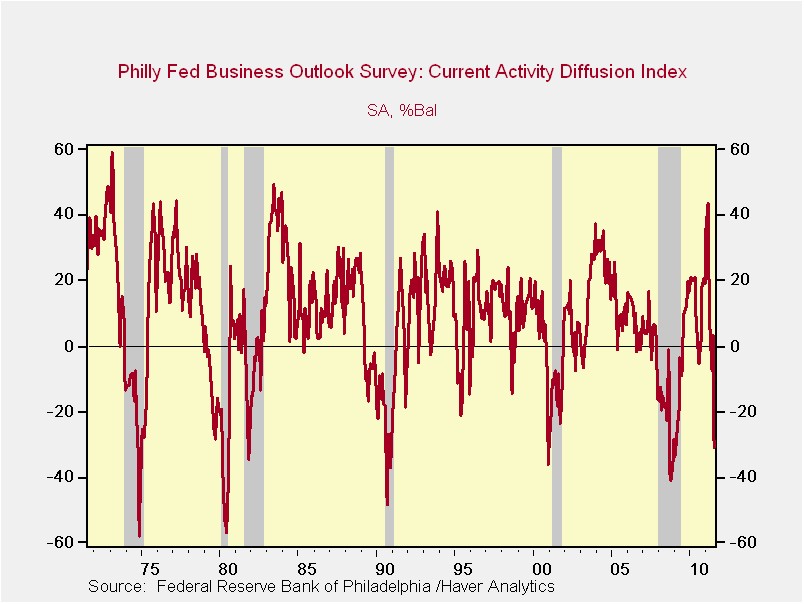

Read MoreIt’s Getting Real with the Recession Indicators

What is the Philadelphia Fed Index? Why has it exacerbated the market’s sharp declines from the morning? (see previous post) In short, the measure is an activity-based survey. It isn’t an actual measurement of anything, other than how people feel or sentiments on a given day. The survey-based results are indicating we are currently in…

Read MoreMorgan Stanley: “Dangerously Close to Recession”

Reasons for the weakness at the open: Morgan Stanley takes estimates from global GDP growth from 4.2% to 3.8% for 2011. Scary front page of the WSJ: “Fed Eyes European Banks” which is what they should be doing but it is still scary as presented. NTAP cut guidance last night and the stock is off…

Read MoreICI Mutual Fund Flows – “A Waterfall”

ici_flow_aug ICI mutual fund flows for the equity asset class (Aug) were released today with an outflow of $23.5B which rivals the exit from equities back in the depths of the financial crisis (late 2008). This marks a stunning, abrupt, run for the exits. While the analogies to 2008-09 abound, we think there are…

Read MoreThe US Economy – not as bad as the headlines (7 reasons why)

While many pundits are talking about recessionary conditions – we would like to point out that the actual environment is much better than this, and in many regards, running at about the same pace now as Q1. We acknowledge that GDP growth has disappointed this year, and come in lower than bullish forecasts from Wall…

Read More