Nike Bone Crusher; China’s Economy isn’t Collapsing

Maybe the economy in China isn’t collapsing.

Maybe the economy in China isn’t collapsing.

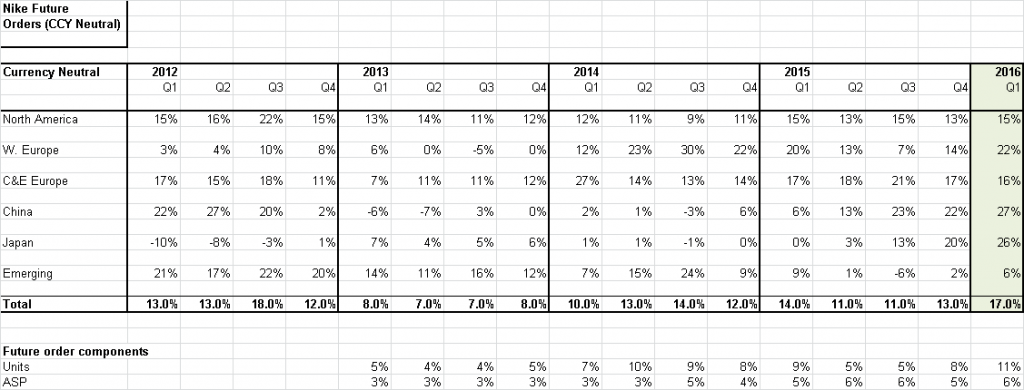

Nike reported a bone crusher of a quarterly report last night; a stark wake-up call for China bears. Nike management credibility is higher than that of the Chinese government, and this earnings report, at this juncture, is stunningly good. Nike segment reports its future orders by geography, adjusted for currency movement, and the results out of China are the strongest since 2012. Nike is surging in China again. Impressive because China isn’t a new market; Nike is entrenched, and has invested, and developed the brand in China for a solid 15 years. The 27% china orders growth accelerated relative to last quarter’s 22% growth. The acceleration took place despite the China A-shares collapse, the renminbi devaluation, and lots of negative press on China macro.

The China bull case is (and has been) for the country to shift emphasis and resources from state directed manufacturing and export sectors, while building a service sector to benefit households. Perhaps some of the initiatives are gaining traction and the economy is transitioning. Nike posting 27% growth in China, if it were in a recession, is inconceivable. When the US stock market flash crashed in August, Tim Cook pointed out that Apple’s China business was strong. The implications are positive for several multinationals in the consumer and technology sector. China not being in a recession is certainly good for Japan, Korea, and Brazil. The market is in risk-on mode, and the data last night from Nike are a decisive factor in swinging sentiment.

CJF, Nike’s sales are not surprising based on the takeaway by a number of commentators on the China stock market crash, who said not to worry about the Chinese economy overall because there are few Chinese invested in the market and that consumer spending would not be affected. However, I think it is a leap too far to posit that because Nike sales are strong, the Chinese economy is managing to undergo its much heralded transition. I don’t see how the two are related. The consumer side of the economy can do well well enough without the needed reforms and makeover needed by the corporate sector. While Nike’s sales are probably a good sign for a lot of companies selling consumer goods in China, I don’t think it says much about any kind of transition.

For China’s economy to transition, the consumption/GDP ratio needs to improve. Consumption/GDP is estimated in the high 30% range. For the US 70%.

If retail sales remain strong (grow) in tandem with the export economy contracting – this is transition. A bullish economic transition would be the export sectors stable/growing slowly, while consumption grows at a faster rate.

The transition won’t be easy, and will be volatile; reforms needed and workers displaced…

CJF, do sales of foreign national, such as Nike, with Chinese operations, get counted toward China’s GDP? I would think that Nike’s China subsidiary (I assume they have one) gets counted toward China’s GDP. But does it get again counted for the US when that money is rolled up to Nike HQ in Beaverton?

Yes, retail sales in China, of all things, Chinese and imported, get counted for in Chinese GDP. You are correct that that the ultimate profit margin of that sale goes to Nike’s shareholders. Generally, countries with a diversified corporate base, and domestically geared companies, have a stronger economic base (not just dependent on exports). There are several Chinese footwear brands like Li Ning and Anta….though the Chinese seem to want Nike if they can afford it. A true basketball country.