Posts Tagged ‘Recession’

Risk-reduction driven market corrections are healthy; this one presents opportunities

The pullback in the market should not be a surprise. The real surprise is the extent of the market’s ascent over the past 18-months, without a single significant draw-down. Corrections are normal during the course of a bull market, and aid in accomplishing a number of items: building the wall of worry; an important source…

Read MoreWhen Greek Debt Servicing Resolves – Spain is the Key to the Eurozone Compact

The Spanish Empire reached the height of its powers in the 1500’s. Naval supremacy, decades of rapidly rising wealth, discovery of gold, and influence over the Catholic papacy led to Spain becoming a dominant world power. It wasn’t until Philip II and The Great Armada’s defeat against the English in the Anglo-Spanish War that Spain’s…

Read MorePhilippine Central Bank – Another Emerging Market Set to Ease Monetary Policy in the First Quarter

The Philippines is a very large nation that is off the radar of most mainstream economic analysis. The country has a population of 93 million, and the economy has enormous potential but exhibits inconsistent growth. The economy of the Philippines has a decently developed electronics/semiconductor industry and a large export industry for fruits, palm oil,…

Read MoreNegative German Yields – Implications for Risk Averse Financial Markets

On Monday, Germany gained entrance to a rarified club of sovereign nations paid to borrow money. This US accomplished this feat during the depths of the financial crisis. Now Germany is able to achieve the same feat during the Eurozone sovereign debt crisis. In a debt auction on Monday, Germany was able to sell 3.9B…

Read MoreOn Paranormal – A Review of the “New-New Normal”

PARANORMAL: beyond the range of normal experience or scientific explanation, not in accordance with scientific laws. A great friend of mine, and incredibly savvy investor, recently pointed me to Bill Gross’ January 2012 Investment Outlook: “Towards the Paranormal”. He suggested it was an intriguing, provocative, and worthwhile read. After reading the four page monthly I…

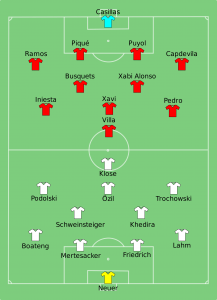

Read MoreSpain & Germany – In Sickness and in Health

The plan forward with the Eurozone crisis is the German plan forward. Germany proposed closer fiscal union and increased austerity for EU-17 nations with high deficits and/or high debt burdens. This path suits German interests well because there is little that needs to be changed. Unfortunately from Spain’s standpoint, the German path forward is not…

Read More2012 Global Investment Themes and Predictions

In 2011, the stock market experienced some dramatic swings, heightened volatility, managed some months of tremendous strength and sickening weakness. After an exhausting ride, the S&P 500 index returned to precisely where it started. For those who appreciate extreme precision, the market was down on the year based on the second decimal point of the…

Read MoreInvesting Ahead of a European Recession

Investing ahead of a recession is like a trip to the dentist for a filling when the Novocain isn’t quite right. You know you are in for some pain, but it’s unclear just how much, and how long it will last. Europe is accepting the German path forward, which will at a minimum, lead to…

Read MoreBlack Friday Retail Sales Strong – Demonstrate the US Economy is Nowhere Near a Recession

A number of Black Friday retail sales surveys were released over the weekend. All measures pointed to a robust start to the holiday shopping season. Strong data were received from the National Retail Federation, ShopperTrak, and Comscore. None of the individual sales measures are completely reliable, but the collective strength is likely indicative of a…

Read MoreEurope’s Crisis Spreads as Spain, Belgium, France, the Euro and EU-17 get Questioned – How Does It End?

For a number of months, the financial crisis in Europe has been explained under the guise of sound versus unsound policy. If this were indeed the case, the fix would be simple; eliminate unsound and unsustainable policy and voila, the problems would just go away. European leaders have shifted blame continuously from one problem to…

Read MoreECB Cuts Rates 25 basis points – Dovish Comments From Draghi

The ECB cut interest rates by 25 bps down to 1.25%. This was somewhat of a surprise cut as many expected Draghi to start his tenor by demonstrating some hawkish resolve – consistent with the views of departing ECB President Jean-Claude Trichet. Draghi presents a viewpoint that inflation is expected to fall further while highlighting…

Read MoreEurope’s Eleventh Hour Fix

After keeping the world on edge and pushing up against the brink of a European recession, details of the European fix are trickling out. It is sure to be a headline filled Thursday, Friday, and weekend. I won’t focus on the specific details because many of them still aren’t known and the ones that have…

Read MoreEurozone PMI – Continues to Slow as Europe Bickers

Economies don’t function well in a “crisis steady state”. In Europe, the business environment has been surprisingly good during the third quarter despite what seems like a concerted effort to induce a collapse. A number of consumer and industrial companies pointed out that growth hasn’t fallen off a cliff and if Europe can simply instill…

Read MoreUS Economy Demonstrates Resiliency – Retailer Comp Sales Strengthen in September

Despite massive uncertainty stemming from the manner in which Europe is handling its financial crisis, a gut wrenching stock market sell-off (the S&P 500 was down 7.2% last month), negative headlines almost every day, and predictions towards the end of the month that the US economy is now “in a recession”, the US consumer continues…

Read MoreExcesses Cause Recession – A Comparison of 2008 and 2011

Recessions are typically caused by some sort of an excess. Real economic activity stretches too far and the subsequent unwind causes a retrenchment via a sudden and abrupt change in business and household behavior. There have been a number of excesses that have built up in the global economy over the past couple of decades.…

Read MoreWhy Can’t We Create Jobs?

I’ve been holding a constructive view on the economy and markets for a number of reasons. The economy isn’t as soft as has been presented and market valuations are extremely low for a non-recessionary environment (if that is indeed the environment we are in). Today’s Employment Report was downright ugly. Being constructive, I could search…

Read MoreRetail Chain Sales Very Strong – No Recession

It was particularly impressive that sales in August were not only strong for retailers that sell lots of food and consumer products (which benefited from the buying panic pre-Irene) but that they were broadly strong. While the food and broadline retailers should have benefited from some buying “pull-forward” before the storm, other retailers such as…

Read More