Posts by crackerjack

On the phase one China Trade Deal

In an unseemly signing ceremony, with a plethora of US CEOs and government officials, 3-4 dignitaries from China, and much bravado from President Trump, the Phase One US-China trade deal was signed and presented to the world. Markets cheered. Aside from the spectacle of it all, there is some cause for short-term optimism over a…

Read MoreWhat a 2019; Outlook for 2020

What an incredible 2019 for markets. The S&P rallied 28% and the NASDAQ 35% (give or take based on final 12/31 closing levels). 2019 returns are somewhat inflated from the low base of December 2018, when the market tanked on hawkish fed fears and the acceleration of the Trade War. Notwithstanding, 2019 was a banner…

Read MoreThe Powell Put is Struck Lower

In spectacular fashion, over the past few weeks, stark reminders emerged on how fast confidence unravels in the midst of a slowdown, particularly so, when the slowdown is doused with policy response errors. A conflux of negatives compounded to send US financial markets into bear market territory, ultimately, calling into question the economic expansion since…

Read MorePTFI

Summarizing an investment mantra into an acronym is a common practice, and generally, a lazy short cut to sum things up. The investment themes for 2017 oscillated from technology/growth, to financials, to Trump tax trade, to retail, and now, to just being long whatever makes sense irrespective of the theme the idea falls under. It’s…

Read MoreOdd Market Swings Intra-day; Volatility Crush Over Multi-day

Earlier this month, April 5th was an odd day for financial markets. During market hours, it was interesting to behold one of the strongest single hours of the year, at the open, when the market rallied 20 handles on no real news of consequence. Sales could be seemingly filled at any price. One felt an…

Read MoreHolding Pattern

The relentless grind higher in equity markets continues irrespective of periods of policy awkwardness, twitter rants, and republican in-fighting. Recent announcements that corporate tax reform isn’t likely until August/September didn’t faze the market at all. Clearly, the benefit of the doubt is being given to the Trump administration to make the American economy greater, and,…

Read More2017

2016 started in a tailspin with spiraling China meltdown fears. Those fears proved to be ill-timed, and against most prognostications, despite BREXIT, the start of Fed rate hikes, and the looniest election anyone can remember with a shocker outcome, the market went on to have a gangbuster 2016, producing a total return of 12%. The…

Read MoreTurkey Day Highs

The bull market is set to turn 9 in 2017. Vanquished by the bull: Eurozone crisis, deflation, China bubbles, taper tantrums, BREXIT, and now Trump. The bullishness of the tape continues to shock, with the Trump rally, after the fact, looking strikingly similar to the BREXIT rally; the market provides every indication that one outcome…

Read MoreTrump; & The Arrogance of The Elites

In shocking, inexplicable, unfathomable, polarizing, surreal fashion, Donald Trump wins the presidency of the United States, by winning the states of Pennsylvania and Wisconsin, along with all of the states expected to lean his way. Stocks, currencies, and commodity markets are in disarray. The S&P 500 futures sank approximately 100 points (~5%) around midnight, with…

Read MoreComplacent Market; Fraught with Risk

In a shockingly flat stretch, noteworthy for the lack of volatility, and an incredibly tight range, the market has gone absolutely NOWHERE from July to October. 20-30 basis point moves feel outsized, even though they are not, in any sort of historical context. On days when the market goes up, the VIX falls to a…

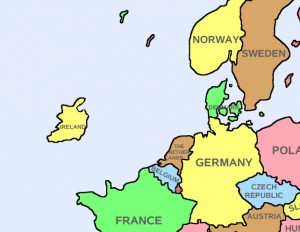

Read MorePounded; BREXIT Risks Hit Markets

In a low volatility, range bound market, it doesn’t take much to cause a break. Rising global bonds yields are a major concern that double-impact the market; higher future business costs of funding growth, financing acquisitions, and implementing share repurchases, while, in tandem, high equity valuations are pressured. Now the market has another major worry.…

Read MoreNo Man’s Land

an anomalous, ambiguous, or indefinite area especially of operation, application, or jurisdiction definition two: financial market direction over the 2015-2016 period The meandering, low-volatility, sine wave oscillations of the tape continue. How did markets arrive at a point where a 3% pull-back is petrifying, and a 5% pull-back feels like a crash? The Brexit pull-back…

Read MoreYellen Fed & Monetary Policy: “Running it Hot”

The September Fed meeting issued few surprises; fed funds were not hiked, as was telegraphed by the Brainard speech. While the Fed maintained interest rates, in the press conference, Yellen once again, found a way to interject incremental dovishness, driving interest rates lower, and asset prices up. The playbook of the Yellen Fed for the…

Read MoreBig in Japan; Can the Fed trump the BOJ?

VIX back to the 15 range ahead of a consequential Fed meeting, deep into the economic cycle. Volatility crush continues into actual central bank announcements. Zombie US markets can’t go down but can’t rally either. After recent, underwhelming ECB announcements, markets sense more to come from the Fed, yet a gasping sense reigns omnipresent. What, actually, can…

Read MoreInmates Running the Asylum; Fed Policy 8-years into Recovery

Last week, a Fed Governor, made comments hitting Bloomberg, that the Fed was not a handmaiden to the markets. The comments, not part of a major speech, and difficult to find on Google, were striking, and provocative, conjuring memories of a period when this would never need to be said. Today’s baffling Fed communication strategy…

Read MoreVolatility Suppression Challenged

Since the BREXIT rebound/rip, it’s been an exceptionally stable summer. Few predicted that the unexpected BREXIT vote, would be an unequivocal positive to markets. The tell, quite clear after the fact, was the global rate plunge, and the US 10-year yield sinking to the 1.35% range, around the 4th of July. The perfect combination arose…

Read MoreOn Brexit

What a tumultuous 5 days. The lurching feeling is all the more acute after a period of one-way markets (up) and declining volatility. With polls shifting towards “Remain” last week, the prospect of all-time highs in the S&P 500 held an aura of inevitability. The unexpected Brexit vote, by a solid 4 point margin, tanked…

Read More