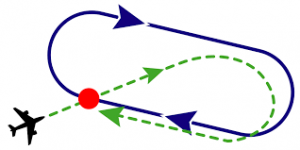

Holding Pattern

The relentless grind higher in equity markets continues irrespective of periods of policy awkwardness, twitter rants, and republican in-fighting. Recent announcements that corporate tax reform isn’t likely until August/September didn’t faze the market at all. Clearly, the benefit of the doubt is being given to the Trump administration to make the American economy greater, and, the Fed is complicit, hinting at a lower for longer interest rate policy, still, into 2017. Not surprisingly, asset price re-ratings persist, and now the bond market, gold, energy, commodities, EM currencies, have all bounced too. Risk pricing remains high, and implicit volatility is exceptionally low.

The relentless grind higher in equity markets continues irrespective of periods of policy awkwardness, twitter rants, and republican in-fighting. Recent announcements that corporate tax reform isn’t likely until August/September didn’t faze the market at all. Clearly, the benefit of the doubt is being given to the Trump administration to make the American economy greater, and, the Fed is complicit, hinting at a lower for longer interest rate policy, still, into 2017. Not surprisingly, asset price re-ratings persist, and now the bond market, gold, energy, commodities, EM currencies, have all bounced too. Risk pricing remains high, and implicit volatility is exceptionally low.

The playbook, between now and the fall, appears limited at first blush, with markets neither likely to rally at an accelerated pace, nor likely to sell off meaningfully, for more than days/hours/minutes. CJF observes with wonder, and continues to ride a mixture of growth investments (mainly in tech) and defensive/high quality investments, with solid yield (mainly in consumer staples, utilities, industrials, energy), and hold a bi-furcated portfolio, continually taking advantage of extraordinarily cheap S&P volatility to hedge with put options. Very few zigs and zags of major consequence in the first quarter, and, so, <insert sigh> continue to let growth stocks grow (damn the valuations), and high quality names have their days, and pay solid dividends.

For those looking for some specific tickers, a list of own-able names that CJF is focusing on:

AAPL, AMZN, GOOGL, NVDA

PEP, MDLZ, BUFF

ED, CVA, MWA, HXL, TRR, HDS, KAR

Good synopsis.. we live in strange times.

AAPL, AMZN, GOOGL?? Come on CJF–picking those stocks is ‘active management’???

Yes Mike – it is.

Is active management Carl Ichan exiting AAPL at $100 citing a “China issue”, before the best 9-month stretch for AAPL stock in a decade?

What is active management anyway? The long/short industry is dying because the market has been one-way. AAPL/AMZN/GOOGL are secular longs – stocks for the era.

It may be sexy to try to find the next batch – but this is fraught with risk and long shots…