Posts Tagged ‘Greece’

Crimea Annexation; the implications for global capital allocation

Around geopolitical events, political posturing is generally the short-term focus for all parties involved, and markets, but the longer-term implications are often unrelated to what is obvious in the short-term. The despotic approach of Vladimir Putin, and his “damn the torpedoes” approach to dealing with market/economic consequences exacerbates this effect. A fascinating take on…

Read MoreEurope’s Prisoner’s Dilemma – LTRO Needs to Continue for Years

European leaders have inadvertently created one of the financial world’s largest negative feedback mechanisms. By issuing long-term refinancing operations (LTRO) with cheap ECB funding for terms up to three years and encouraging European banks to take the funding and purchase assets such as sovereign debt, the ECB effectively has encouraged the European financial system to…

Read MoreDeja Déjà Vu – A Third Summer of European Crisis

Over the past week, it has become clear that a third annual conflagration throughout Europe is upon us. The crisis has morphed yet again, and like The Hydra, it has come back in a more menacing form. The issue this summer is more profound than the “sovereign debt crisis” which struck last summer. Last summer’s…

Read MoreWhen Greek Debt Servicing Resolves – Spain is the Key to the Eurozone Compact

The Spanish Empire reached the height of its powers in the 1500’s. Naval supremacy, decades of rapidly rising wealth, discovery of gold, and influence over the Catholic papacy led to Spain becoming a dominant world power. It wasn’t until Philip II and The Great Armada’s defeat against the English in the Anglo-Spanish War that Spain’s…

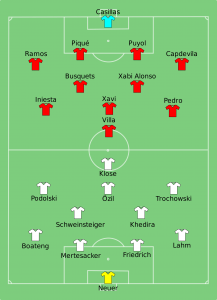

Read MoreSpain & Germany – In Sickness and in Health

The plan forward with the Eurozone crisis is the German plan forward. Germany proposed closer fiscal union and increased austerity for EU-17 nations with high deficits and/or high debt burdens. This path suits German interests well because there is little that needs to be changed. Unfortunately from Spain’s standpoint, the German path forward is not…

Read MoreInvesting Ahead of a European Recession

Investing ahead of a recession is like a trip to the dentist for a filling when the Novocain isn’t quite right. You know you are in for some pain, but it’s unclear just how much, and how long it will last. Europe is accepting the German path forward, which will at a minimum, lead to…

Read MoreEurope’s Crisis Spreads as Spain, Belgium, France, the Euro and EU-17 get Questioned – How Does It End?

For a number of months, the financial crisis in Europe has been explained under the guise of sound versus unsound policy. If this were indeed the case, the fix would be simple; eliminate unsound and unsustainable policy and voila, the problems would just go away. European leaders have shifted blame continuously from one problem to…

Read MoreEurope Must Decide Its Future – Self Induced Financial Crisis Has Led Europe to the Brink

After Wednesday’s market action around the world, it’s a good time for a big picture assessment on the state of the financial markets. The attitude out of Europe has pendulated between nonchalance and vitriolic attacks among the EU-17. Italian sovereign rates spiraling above 7% have brought the eleventh hour upon the region. Escalation of the…

Read MoreWhen Will the Market Start to be Forward Looking – Early Signals from Asia?

The markets have been through a period of wicked volatility with a significant pullback almost to the point of entering a new bear market. Intraday the S&P 500 was down 20% from its high but closed above those levels and went up from there. From the market’s closing bottom of 1,099 the S&P had a…

Read MoreEurope’s Eleventh Hour Fix

After keeping the world on edge and pushing up against the brink of a European recession, details of the European fix are trickling out. It is sure to be a headline filled Thursday, Friday, and weekend. I won’t focus on the specific details because many of them still aren’t known and the ones that have…

Read MoreFinancial Conditions are Driving all the Market Fears

Positive data and developments on the real economy front are being ignored while increases in financial stress are being focused on. The pervasive gloom in the financial markets is a result of growing fears of another financial crisis. If this were to unfold, the financial crisis would surely cause a global recession but I’m remaining…

Read MoreGreece Will Stay On Board – Merkel and Papandreou Plan a Dinner Date in Berlin

Greece will ultimately stay on board. There I’ve said it – and it is really what I think will happen. There were a number of “unity” headlines hitting over night which have led to a continuation of the rally in global risk assets. Emerging Markets which looked sufficiently panic sold to call out yesterday are…

Read MoreEurope’s Minimalist Approach Is the Wrong Course

What an 18 hours, as a conflux of negatives weigh on the market. In wrenching fashion, the US markets are down 6% since yesterday at 2:00pm. Most international markets around the world are down significantly more. Many emerging markets are off over 10% over two days. The Fed implemented Operation Twist yesterday, and the size…

Read MoreWhy A European Sovereign Debt Crisis Can Be Avoided

The European sovereign debt crisis has dominated financial news and been the primary driver of markets for the past month. I would argue that we are in an actual crisis in Europe and this is no longer about fears of a crisis. When banks can’t finance independently through the market and when large countries can’t…

Read MoreInvesting In Europe – Now the Risk/Reward Is Attractive

Yesterday, I reviewed the reasons why the Eurozone as a monetary union is a flawed construct and why the implications for a breakup are disastrous. I believe this is so much the case, that the odds of a Eurozone unwind are actually quite low. The breakup option is really the self-immolation option as all parties…

Read MoreEurozone Breakup – Implications for Financial Markets are Disastrous

Over Labor Day weekend we saw an unfortunate breakdown in Europe’s approach, strategy, and near-term ability to avoid a financial crisis. In the Mecklenburg Western Pomerian state (along the coast of the Baltic Sea), Germans voted against the Christian Democratic Union which is a repudiation of Angela Merkel’s support and commitment to the Eurozone. I’ll…

Read MoreGreek Stock Market Surges on M&A

The Greek stock market is having a melt-up this morning, with the largest gains in 20-years. The index as a whole is up 14%, which isn’t bad for those who managed to get long Greek equities on Friday. And for more adventurous and daring sorts, the Cypriot stock market is up 18.5% this morning; Cyprus is leveraged…

Read More