Posts Tagged ‘Germany’

Europe’s Prisoner’s Dilemma – LTRO Needs to Continue for Years

European leaders have inadvertently created one of the financial world’s largest negative feedback mechanisms. By issuing long-term refinancing operations (LTRO) with cheap ECB funding for terms up to three years and encouraging European banks to take the funding and purchase assets such as sovereign debt, the ECB effectively has encouraged the European financial system to…

Read MoreDeja Déjà Vu – A Third Summer of European Crisis

Over the past week, it has become clear that a third annual conflagration throughout Europe is upon us. The crisis has morphed yet again, and like The Hydra, it has come back in a more menacing form. The issue this summer is more profound than the “sovereign debt crisis” which struck last summer. Last summer’s…

Read MoreLike QE, the ECB’s Long-Term Refinancing Operations Will Continue for Years

I came across an article in The Telegraph by Ambrose Evans-Pritchard which does a good job highlighting the circularity of the ECB’s LTRO and associated bond buying. As banks throughout Europe took advantage of ECB stimulus, which they were de facto encouraged to do by Mario Draghi and the ECB, it is clear that both…

Read MoreWelcome to the World, North Korea – Investment Opportunities Will Eventually Sprout

North Korea has been isolated since the disintegration of the Soviet Union in 1991. Significant amounts of communist aid ceased, and the fall of communism across Eastern Europe ultimately had a profound impact on the Democratic People’s Republic of Korea for the next two decades. North Korea was figuratively and literally off the grid as…

Read MoreWhen Greek Debt Servicing Resolves – Spain is the Key to the Eurozone Compact

The Spanish Empire reached the height of its powers in the 1500’s. Naval supremacy, decades of rapidly rising wealth, discovery of gold, and influence over the Catholic papacy led to Spain becoming a dominant world power. It wasn’t until Philip II and The Great Armada’s defeat against the English in the Anglo-Spanish War that Spain’s…

Read MoreInflation in Europe is Sticky – Another Reason the ECB to Remain Balanced

December inflation data was released this morning in France and Germany. In both countries, the inflation rate was higher than expected and failed to come down relative to prior months. EU harmonized German inflation was reported at 2.3% and EU harmonized French inflation was 2.7%. Two large economies yet to report inflation data are Spain…

Read MoreNegative German Yields – Implications for Risk Averse Financial Markets

On Monday, Germany gained entrance to a rarified club of sovereign nations paid to borrow money. This US accomplished this feat during the depths of the financial crisis. Now Germany is able to achieve the same feat during the Eurozone sovereign debt crisis. In a debt auction on Monday, Germany was able to sell 3.9B…

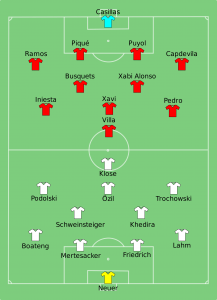

Read MoreSpain & Germany – In Sickness and in Health

The plan forward with the Eurozone crisis is the German plan forward. Germany proposed closer fiscal union and increased austerity for EU-17 nations with high deficits and/or high debt burdens. This path suits German interests well because there is little that needs to be changed. Unfortunately from Spain’s standpoint, the German path forward is not…

Read More2012 Global Investment Themes and Predictions

In 2011, the stock market experienced some dramatic swings, heightened volatility, managed some months of tremendous strength and sickening weakness. After an exhausting ride, the S&P 500 index returned to precisely where it started. For those who appreciate extreme precision, the market was down on the year based on the second decimal point of the…

Read MoreInvesting Ahead of a European Recession

Investing ahead of a recession is like a trip to the dentist for a filling when the Novocain isn’t quite right. You know you are in for some pain, but it’s unclear just how much, and how long it will last. Europe is accepting the German path forward, which will at a minimum, lead to…

Read MoreThe Rest of Europe Can’t be German

The EU Summit and ECB meeting which transpired last week are likely to be the final supporting actions by Eurozone officials this year. The tack forward for Europe has been clarified; move ahead with the long and arduous process of fiscal unification, supported by a reactive ECB. The path ensures two outcomes; that there will…

Read MoreECB Cuts Rates 25 Basis Points to 1% – Hawkish Press Conference Q&A Squashes Hopes of Sovereign Debt Purchases in Larger Amounts

The ECB issued a terse press release detailing an interest rate cut for the main refinancing operations of the Eurosystem (from 1.25% to 1.0%) commencing on December 14th. In addition, the ECB cut rates on the marginal lending facility and deposit facility by 25 basis points. This move was widely expected and had a limited…

Read MoreStandard & Poors Places Europe on Negative Credit Watch – World Set for Downgrade!?

I find it rather ironic that Standard & Poors placed the EU-17 on negative credit watch on the same day the market provided the strongest one-day positive assessment to peripheral Europe’s sovereign credit outlook since August (borrowing costs were down sharply on Monday). I have no issue with actually conducting a downgrade of the entire…

Read MoreMario Monti Announces Serious Austerity Plan for Italy – 2013 Balanced Budget Target Leads to Sovereign Debt Rally

Italian Prime Minister, Mario Monti, announced sweeping austerity measures and reforms, bolstering confidence in Italian sovereign debt markets. Monti’s plan includes tax increases, government spending cuts, pension savings and raising the retirement age. Italy needs to enact these reforms over the next couple of years, and there are some political risks to implementation, but the…

Read MoreGermany’s First Failed Bond Auction – The European Crisis Continues to Spread

Germany failed to get bids for 35% of the 10-year bonds auctioned today. Yields are up about 10 basis points this morning. The increase in borrowing cost is insignificant for Germany. Yields are still well below 2%, and Germany continues to benefit from the combination of very low borrowing costs, and a declining euro which…

Read MoreQue Lastima – Spain in a Vice as Interest Rates and Unemployment Soar

I’ve been writing about the impossibility of the ECB running appropriate monetary policy for 17 different nations. The dilemma couldn’t be more evident when contrasting the economy of Spain with the economy of Germany. Spain actually has less sovereign debt relative to GDP than does Germany. The problem for Spain isn’t the level of debt…

Read MoreEurope’s Crisis Spreads as Spain, Belgium, France, the Euro and EU-17 get Questioned – How Does It End?

For a number of months, the financial crisis in Europe has been explained under the guise of sound versus unsound policy. If this were indeed the case, the fix would be simple; eliminate unsound and unsustainable policy and voila, the problems would just go away. European leaders have shifted blame continuously from one problem to…

Read More