Posts by crackerjack

How Heavily Shorted is Facebook?

It is well known how the Facebook (FB) IPO is setting up to be the flop of the decade. Stunning that one of the profound technological/media companies of a generation is now such a historically awful IPO. There are plenty of negatives stemming from the debacle including: Continued disillusion from retail investors who heavily participated…

Read MoreHeinz – An Emerging Market Food Leader

Heinz (HNZ) had an Analyst Day on Thursday last week with about four hours of management presentations and Q&A posted on the investor relations section of the Heinz website. This presentation is a wonderful way to understand the Heinz business model and appreciate the strategic vision of the company. Heinz stock had a relatively strong…

Read MoreEurope’s Prisoner’s Dilemma – LTRO Needs to Continue for Years

European leaders have inadvertently created one of the financial world’s largest negative feedback mechanisms. By issuing long-term refinancing operations (LTRO) with cheap ECB funding for terms up to three years and encouraging European banks to take the funding and purchase assets such as sovereign debt, the ECB effectively has encouraged the European financial system to…

Read MoreDeja Déjà Vu – A Third Summer of European Crisis

Over the past week, it has become clear that a third annual conflagration throughout Europe is upon us. The crisis has morphed yet again, and like The Hydra, it has come back in a more menacing form. The issue this summer is more profound than the “sovereign debt crisis” which struck last summer. Last summer’s…

Read MoreLike QE, the ECB’s Long-Term Refinancing Operations Will Continue for Years

I came across an article in The Telegraph by Ambrose Evans-Pritchard which does a good job highlighting the circularity of the ECB’s LTRO and associated bond buying. As banks throughout Europe took advantage of ECB stimulus, which they were de facto encouraged to do by Mario Draghi and the ECB, it is clear that both…

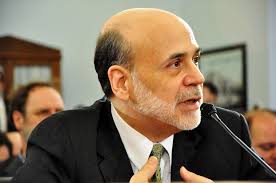

Read MoreBernanke’s Labor Market Speech – The Case for Continued Accommodative Policy

Ben Bernanke made a highly referenced speech earlier this week, credited with fueling a sharp rally in the stock market. The speech is colorfully titled: “Recent Developments in the Labor Market” and is a worthwhile read for investors and those interested in the US economy. The speech highlights a growing controversy in the labor market…

Read MoreWelcome to the World, North Korea – Investment Opportunities Will Eventually Sprout

North Korea has been isolated since the disintegration of the Soviet Union in 1991. Significant amounts of communist aid ceased, and the fall of communism across Eastern Europe ultimately had a profound impact on the Democratic People’s Republic of Korea for the next two decades. North Korea was figuratively and literally off the grid as…

Read MoreFirst the Japanese Yen and then Gold – There is No Safe Haven Currency Panacea

Beware of the one-way, one-speed runaway train! Usually in the normal chain of events the train stops, lets the passengers off, turns around, and starts going the other way. In a rare circumstance, all hell breaks loose and the train can’t be turned around and runs off the track and over the cliff. In the…

Read MoreThe Economic Process of Deleveraging Part Two – Why the US is Well Positioned

The differences between the US situation post-financial crisis and Japan in 1990 are stark. The previous post outlined how extreme things got in Japan and how ahead of itself the Japanese stock market, real estate market and economy got. While Japan was exposed to “extreme extremes” the US economy experienced imbalances that could be worked…

Read MoreThe Economic Process of Deleveraging Part One – What Happened in Japan?

The process of deleveraging has been in place since the onset of global recession and financial crisis in 2008. Many investors and economists have highlighted how long the process can take once it gets going. It’s striking how the theme of deleveraging, broadly speaking, is universally assumed to play out over a very long time.…

Read MoreWhen Greek Debt Servicing Resolves – Spain is the Key to the Eurozone Compact

The Spanish Empire reached the height of its powers in the 1500’s. Naval supremacy, decades of rapidly rising wealth, discovery of gold, and influence over the Catholic papacy led to Spain becoming a dominant world power. It wasn’t until Philip II and The Great Armada’s defeat against the English in the Anglo-Spanish War that Spain’s…

Read MoreGlobal Demographics – An Important Multi-Year Investment Theme

With much fanfare, estimates of the earth’s population recently surpassed 7 billion people. Population growth rates have been staggering for decades, for a number of reasons. The straightforward explanation is that global birth rates have remained high while there has been tremendous improvement in child mortality rates and life expectancy. Sewer system implementation in the…

Read MoreInvestment Themes for Q4 Earnings Season

Fourth quarter earnings season is upon us while the market is off to a torrid start to the year. While the S&P 500 is up 4% year-to-date, there are a number of riskier indexes and sectors doing considerably better. The NASDAQ is up 6.3%, the Russell 2000 5.2%, the Hang Seng 7.6%, the Brazilian BOVESPA…

Read MoreInflation in Europe is Sticky – Another Reason the ECB to Remain Balanced

December inflation data was released this morning in France and Germany. In both countries, the inflation rate was higher than expected and failed to come down relative to prior months. EU harmonized German inflation was reported at 2.3% and EU harmonized French inflation was 2.7%. Two large economies yet to report inflation data are Spain…

Read MorePhilippine Central Bank – Another Emerging Market Set to Ease Monetary Policy in the First Quarter

The Philippines is a very large nation that is off the radar of most mainstream economic analysis. The country has a population of 93 million, and the economy has enormous potential but exhibits inconsistent growth. The economy of the Philippines has a decently developed electronics/semiconductor industry and a large export industry for fruits, palm oil,…

Read MoreNegative German Yields – Implications for Risk Averse Financial Markets

On Monday, Germany gained entrance to a rarified club of sovereign nations paid to borrow money. This US accomplished this feat during the depths of the financial crisis. Now Germany is able to achieve the same feat during the Eurozone sovereign debt crisis. In a debt auction on Monday, Germany was able to sell 3.9B…

Read MoreOn Paranormal – A Review of the “New-New Normal”

PARANORMAL: beyond the range of normal experience or scientific explanation, not in accordance with scientific laws. A great friend of mine, and incredibly savvy investor, recently pointed me to Bill Gross’ January 2012 Investment Outlook: “Towards the Paranormal”. He suggested it was an intriguing, provocative, and worthwhile read. After reading the four page monthly I…

Read More