Posts Tagged ‘Sovereign Debt’

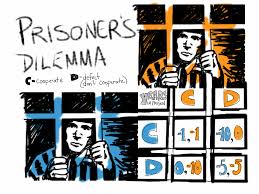

Europe’s Prisoner’s Dilemma – LTRO Needs to Continue for Years

European leaders have inadvertently created one of the financial world’s largest negative feedback mechanisms. By issuing long-term refinancing operations (LTRO) with cheap ECB funding for terms up to three years and encouraging European banks to take the funding and purchase assets such as sovereign debt, the ECB effectively has encouraged the European financial system to…

Read MoreDeja Déjà Vu – A Third Summer of European Crisis

Over the past week, it has become clear that a third annual conflagration throughout Europe is upon us. The crisis has morphed yet again, and like The Hydra, it has come back in a more menacing form. The issue this summer is more profound than the “sovereign debt crisis” which struck last summer. Last summer’s…

Read MoreOn Paranormal – A Review of the “New-New Normal”

PARANORMAL: beyond the range of normal experience or scientific explanation, not in accordance with scientific laws. A great friend of mine, and incredibly savvy investor, recently pointed me to Bill Gross’ January 2012 Investment Outlook: “Towards the Paranormal”. He suggested it was an intriguing, provocative, and worthwhile read. After reading the four page monthly I…

Read MoreThe Rest of Europe Can’t be German

The EU Summit and ECB meeting which transpired last week are likely to be the final supporting actions by Eurozone officials this year. The tack forward for Europe has been clarified; move ahead with the long and arduous process of fiscal unification, supported by a reactive ECB. The path ensures two outcomes; that there will…

Read MoreECB Cuts Rates 25 Basis Points to 1% – Hawkish Press Conference Q&A Squashes Hopes of Sovereign Debt Purchases in Larger Amounts

The ECB issued a terse press release detailing an interest rate cut for the main refinancing operations of the Eurosystem (from 1.25% to 1.0%) commencing on December 14th. In addition, the ECB cut rates on the marginal lending facility and deposit facility by 25 basis points. This move was widely expected and had a limited…

Read MoreMario Monti Announces Serious Austerity Plan for Italy – 2013 Balanced Budget Target Leads to Sovereign Debt Rally

Italian Prime Minister, Mario Monti, announced sweeping austerity measures and reforms, bolstering confidence in Italian sovereign debt markets. Monti’s plan includes tax increases, government spending cuts, pension savings and raising the retirement age. Italy needs to enact these reforms over the next couple of years, and there are some political risks to implementation, but the…

Read MoreChina Starts Monetary Policy Easing Cycle & Rest of World Provides Additional Liquidity

Overnight, financial market sentiment turned around pretty dramatically. The China A-Share market sold-off by 3.3% and approached the vicinity of recent lows. Fears started to mount that Chinese central bankers were going to be slow to ease monetary policy based on continued inflation concerns. After Asian markets closed, the People’s Bank of China announced that…

Read MoreGreece Will Stay On Board – Merkel and Papandreou Plan a Dinner Date in Berlin

Greece will ultimately stay on board. There I’ve said it – and it is really what I think will happen. There were a number of “unity” headlines hitting over night which have led to a continuation of the rally in global risk assets. Emerging Markets which looked sufficiently panic sold to call out yesterday are…

Read MoreWhy A European Sovereign Debt Crisis Can Be Avoided

The European sovereign debt crisis has dominated financial news and been the primary driver of markets for the past month. I would argue that we are in an actual crisis in Europe and this is no longer about fears of a crisis. When banks can’t finance independently through the market and when large countries can’t…

Read MoreChitaly Starts to Mambo Italiano – China in Talks To Buy Italian Sovereign Debt?

I mentioned this possibility over a month ago on August 5th, in the story “Chitaly – China to Purchase Italian Sovereign Debt?” Headlines just hit that Italy is in talks with China to directly buy Italian bonds according to the FT. This headline caused an immediate lift to depressed markets which is quickly getting faded. I believe this may…

Read MoreFrance to be downgraded – it should be – it doesn’t matter

Rumors are swirling that France is about to be downgraded by Standard & Poor’s. We do not believe France should be downgraded, unless every nation that is rated “AAA” changed to “AA” on Standard & Poor’s definition of “AA”. No country should have a higher sovereign credit rating than the US. No other nation has the world’s…

Read MoreMarket Fears of a Recession in 2012

Well, the market clearly isn’t looking for the light at the end of the tunnel. Italian 10-YR bonds have surged, rallying 80 basis points (from a 6.09% yield on Friday to 5.29% yield today). Spanish 10-YR bonds have also surged, rallying 88 basis points (from a 6.03% yield on Friday to a 5.14% yield today).…

Read More