Posts Tagged ‘Fed’

Big in Japan; Can the Fed trump the BOJ?

VIX back to the 15 range ahead of a consequential Fed meeting, deep into the economic cycle. Volatility crush continues into actual central bank announcements. Zombie US markets can’t go down but can’t rally either. After recent, underwhelming ECB announcements, markets sense more to come from the Fed, yet a gasping sense reigns omnipresent. What, actually, can…

Read MoreMidsummer Issues Persist; Divergent Global Central Bank Actions Create Challenges

The market moves fast. Thankfully, in the rest of the world, trends of all kinds, generally move at a measured pace. The market overreacts to events and day-to-day happenings based on crowd think and behavioral issues. A change in trend will often start with a subtle data point or indicator, which in hindsight, ignites a…

Read More5 Investment Patterns That Don’t Make Sense

2015 is shaping up to be a challenging year for investments. The market swoon in mid-August caught most off-guard, and the subsequent violent recovery arrived right after several prominent investors turned bearish, or at least hedged. Markets don’t need to make any sense, and at times, understanding “why” the market is getting crushed, or exploding,…

Read MoreInvesting Ahead of a European Recession

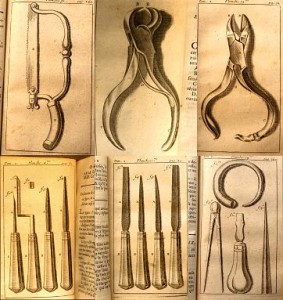

Investing ahead of a recession is like a trip to the dentist for a filling when the Novocain isn’t quite right. You know you are in for some pain, but it’s unclear just how much, and how long it will last. Europe is accepting the German path forward, which will at a minimum, lead to…

Read MoreThe Rest of Europe Can’t be German

The EU Summit and ECB meeting which transpired last week are likely to be the final supporting actions by Eurozone officials this year. The tack forward for Europe has been clarified; move ahead with the long and arduous process of fiscal unification, supported by a reactive ECB. The path ensures two outcomes; that there will…

Read MoreAnalysis of the Fed Minutes – Dovish Tone Remains

The Fed minutes released today at 2:00pm didn’t provide anything that was too much of a surprise. The general impression I felt after reading the 12 pages was that the Fed remains exceptionally dovish. Economic growth, while not rolling-over, remains disappointing, so the Fed is looking to remain accommodative. Inflation was discussed in dovish terms.…

Read MoreBen Bernanke’s Jackson Hole Speech: A Step In The Right Direction

I just read Ben Bernanke’s speech at Jackson Hole, and think it is one of the better speeches he has done in some time. I read some acknowledgement that there is little more the Fed can actually do to improve the US economy. This is of course true. Bernanke realizes he can only create an…

Read More