Posts Tagged ‘Europe’

Heinz – An Emerging Market Food Leader

Heinz (HNZ) had an Analyst Day on Thursday last week with about four hours of management presentations and Q&A posted on the investor relations section of the Heinz website. This presentation is a wonderful way to understand the Heinz business model and appreciate the strategic vision of the company. Heinz stock had a relatively strong…

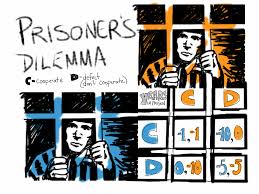

Read MoreEurope’s Prisoner’s Dilemma – LTRO Needs to Continue for Years

European leaders have inadvertently created one of the financial world’s largest negative feedback mechanisms. By issuing long-term refinancing operations (LTRO) with cheap ECB funding for terms up to three years and encouraging European banks to take the funding and purchase assets such as sovereign debt, the ECB effectively has encouraged the European financial system to…

Read MoreFirst the Japanese Yen and then Gold – There is No Safe Haven Currency Panacea

Beware of the one-way, one-speed runaway train! Usually in the normal chain of events the train stops, lets the passengers off, turns around, and starts going the other way. In a rare circumstance, all hell breaks loose and the train can’t be turned around and runs off the track and over the cliff. In the…

Read More2012 Global Investment Themes and Predictions

In 2011, the stock market experienced some dramatic swings, heightened volatility, managed some months of tremendous strength and sickening weakness. After an exhausting ride, the S&P 500 index returned to precisely where it started. For those who appreciate extreme precision, the market was down on the year based on the second decimal point of the…

Read MoreLack of Confidence – A Key Driver of Investment Returns in 2011 – An Opportunity and Risk for 2012

2011 has been a difficult year for most investors. Market sentiment oscillated throughout the year and generating returns has been exceedingly difficult to come by, let alone maintain. The world experienced at least three distinct crisis; Japanese nuclear disaster, Arab Spring, and Sovereign Debt contagion through Europe. All three of these events were enough to…

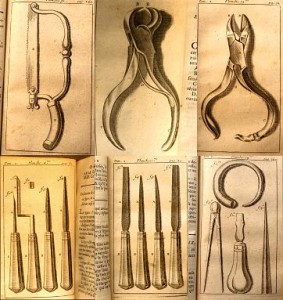

Read MoreInvesting Ahead of a European Recession

Investing ahead of a recession is like a trip to the dentist for a filling when the Novocain isn’t quite right. You know you are in for some pain, but it’s unclear just how much, and how long it will last. Europe is accepting the German path forward, which will at a minimum, lead to…

Read MoreThe Rest of Europe Can’t be German

The EU Summit and ECB meeting which transpired last week are likely to be the final supporting actions by Eurozone officials this year. The tack forward for Europe has been clarified; move ahead with the long and arduous process of fiscal unification, supported by a reactive ECB. The path ensures two outcomes; that there will…

Read MoreStandard & Poors Places Europe on Negative Credit Watch – World Set for Downgrade!?

I find it rather ironic that Standard & Poors placed the EU-17 on negative credit watch on the same day the market provided the strongest one-day positive assessment to peripheral Europe’s sovereign credit outlook since August (borrowing costs were down sharply on Monday). I have no issue with actually conducting a downgrade of the entire…

Read MoreGermany’s First Failed Bond Auction – The European Crisis Continues to Spread

Germany failed to get bids for 35% of the 10-year bonds auctioned today. Yields are up about 10 basis points this morning. The increase in borrowing cost is insignificant for Germany. Yields are still well below 2%, and Germany continues to benefit from the combination of very low borrowing costs, and a declining euro which…

Read MoreEmerging Market Currencies Signaling More Risk Aversion

For almost a decade, emerging markets have been in a bull market with high growth rates, declining interest rates, and capital inflows. During the financial crisis, emerging markets were hit like financial assets around the world, and capital flowed out of the asset class. Over the course of 2010, and most of 2011, emerging market…

Read More“Super” Committee – Lack of Progress Heightens Risks to Economy and Financial Markets

The US “Super Committee” failed to make any progress on the sole task it was created for: deficit reduction. It now appears probable that there will be an announcement today stating the committee has “failed to reach its mandated goal of reducing deficits over the next 10-years by $1.2 trillion dollars”. An announcement of this…

Read MoreEurope’s Crisis Spreads as Spain, Belgium, France, the Euro and EU-17 get Questioned – How Does It End?

For a number of months, the financial crisis in Europe has been explained under the guise of sound versus unsound policy. If this were indeed the case, the fix would be simple; eliminate unsound and unsustainable policy and voila, the problems would just go away. European leaders have shifted blame continuously from one problem to…

Read MoreEurope Must Decide Its Future – Self Induced Financial Crisis Has Led Europe to the Brink

After Wednesday’s market action around the world, it’s a good time for a big picture assessment on the state of the financial markets. The attitude out of Europe has pendulated between nonchalance and vitriolic attacks among the EU-17. Italian sovereign rates spiraling above 7% have brought the eleventh hour upon the region. Escalation of the…

Read MoreECB Cuts Rates 25 basis points – Dovish Comments From Draghi

The ECB cut interest rates by 25 bps down to 1.25%. This was somewhat of a surprise cut as many expected Draghi to start his tenor by demonstrating some hawkish resolve – consistent with the views of departing ECB President Jean-Claude Trichet. Draghi presents a viewpoint that inflation is expected to fall further while highlighting…

Read MoreEurope’s Eleventh Hour Fix

After keeping the world on edge and pushing up against the brink of a European recession, details of the European fix are trickling out. It is sure to be a headline filled Thursday, Friday, and weekend. I won’t focus on the specific details because many of them still aren’t known and the ones that have…

Read MoreAnalysis of the Fed Minutes – Dovish Tone Remains

The Fed minutes released today at 2:00pm didn’t provide anything that was too much of a surprise. The general impression I felt after reading the 12 pages was that the Fed remains exceptionally dovish. Economic growth, while not rolling-over, remains disappointing, so the Fed is looking to remain accommodative. Inflation was discussed in dovish terms.…

Read MoreA Commitment to Recapitalize European Banks is Bullish for US Financials

The Euro rallied 2% today against the USD causing a sharp reversal of crisis-fearing “risk off” trades which have been working against all financial markets around the world. The Euro rallied based on indications that France and Germany are going to work seriously towards recapitalization of the European banking sector. This has been one of…

Read More