Posts Tagged ‘QE’

The Powell Put is Struck Lower

In spectacular fashion, over the past few weeks, stark reminders emerged on how fast confidence unravels in the midst of a slowdown, particularly so, when the slowdown is doused with policy response errors. A conflux of negatives compounded to send US financial markets into bear market territory, ultimately, calling into question the economic expansion since…

Read MoreSuper Dovish Fed Persists

The Fed’s lack of policy response, and subsequent press conference, evokes memories of a scene in Bronx Tale… What’s going on here? Now you can’t leave. I will never forget the look on their faces. All eight of them.Their faces dropped. All their courage and strength was drained from their bodies. They had a reputation for breaking up…

Read MoreChina in Recession; Yuan Depreciation Imminent

China is at the end-game of its great economic transformation. Multiple iterations of 5-year plans, and flawed central economic planning, created a massive build-up in debt that can no longer be continued. China’s debt fueled growth is understood, but the impact of the deleveraging phase is becoming evident in real time. Various estimates of China…

Read MoreEmerging Market Doldrums

Not out of the woods yet – no way. The world has changed in the past week, and unmistakably, extreme volatility (mostly of the down kind) is back within financial markets. The potential of Fed rate hike cycle, in the not too distant future, is wreaking havoc. An unintended consequences of the extended period of…

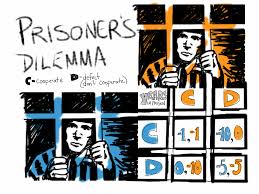

Read MoreEurope’s Prisoner’s Dilemma – LTRO Needs to Continue for Years

European leaders have inadvertently created one of the financial world’s largest negative feedback mechanisms. By issuing long-term refinancing operations (LTRO) with cheap ECB funding for terms up to three years and encouraging European banks to take the funding and purchase assets such as sovereign debt, the ECB effectively has encouraged the European financial system to…

Read MoreLike QE, the ECB’s Long-Term Refinancing Operations Will Continue for Years

I came across an article in The Telegraph by Ambrose Evans-Pritchard which does a good job highlighting the circularity of the ECB’s LTRO and associated bond buying. As banks throughout Europe took advantage of ECB stimulus, which they were de facto encouraged to do by Mario Draghi and the ECB, it is clear that both…

Read MoreFirst the Japanese Yen and then Gold – There is No Safe Haven Currency Panacea

Beware of the one-way, one-speed runaway train! Usually in the normal chain of events the train stops, lets the passengers off, turns around, and starts going the other way. In a rare circumstance, all hell breaks loose and the train can’t be turned around and runs off the track and over the cliff. In the…

Read MoreOperation Twist – What the Fed May Announce Today and the Implications

The Federal Reserve is likely to announce additional easing measures at the conclusion of the two-day Fed meeting today. Additional easing is anticipated by the market but there are a number of uncertainties related to the scope of what the Fed will implement. The most focused on initiative is called “Operation Twist” which is jargon…

Read More