Nike Business On Fire; China Accelerates

Nike (NKE) is in the midst of a strong 3-year run; operating trends are at cycle-high growth rates, health & wellness as a category is growing around the world, and Nike’s brand stewardship is incredibly on point across all major sports. The stock price followed results this year, up over 37% ytd, and the 35th best performer in the S&P 500. Nike’s earnings are expected to grow 16%, so part of the strong return has been valuation re-rating. Nike’s forward P/E multiple reached the 30s, uncharted waters for the firm relative to its history.

Nike (NKE) is in the midst of a strong 3-year run; operating trends are at cycle-high growth rates, health & wellness as a category is growing around the world, and Nike’s brand stewardship is incredibly on point across all major sports. The stock price followed results this year, up over 37% ytd, and the 35th best performer in the S&P 500. Nike’s earnings are expected to grow 16%, so part of the strong return has been valuation re-rating. Nike’s forward P/E multiple reached the 30s, uncharted waters for the firm relative to its history.

Keys to the successful Nike business model:

- The outsourcing of manufacturing to China enables a capital light business model, allowing Nike to focus on the truly value added aspects of design, innovation, and branding.

- Nike never levered up, carrying virtually no debt until late 2013. Today Nike maintains a cash balance greater than total debt, and debt/EBITDA is well below 1x. Nike’s over-capitalized balance sheet enabled unencumbered investment in branding and international marketing.

- Growth is of the organic variety with acquisitions scarce. The major acquisition in Nike’s corporate history was a home run, Converse.

- With an entrenched, globally dominant brand position, Nike now carries the flexibility to take on some debt, and repurchase shares to fuel EPS growth, all from an unassailable position.

- Nike invested in China (a basketball country) early, and will reap tremendous rewards for the foreseeable future.

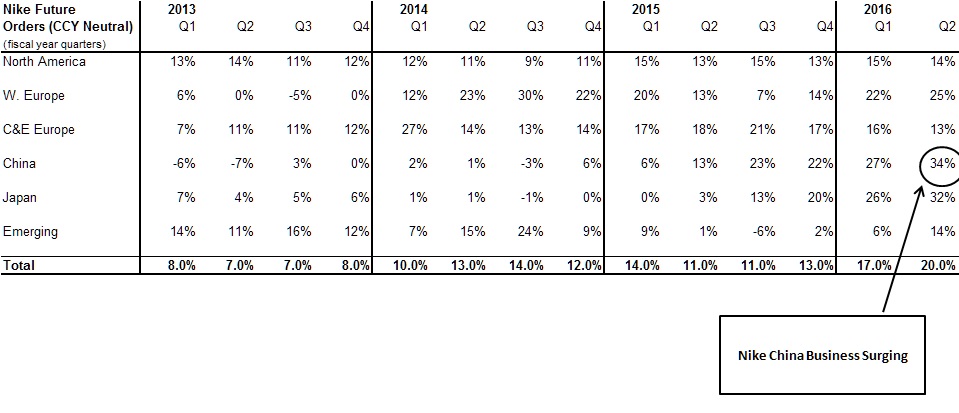

Nike’s business accelerated across four major geographies:

Nike hosted an upbeat quarterly conference call. There is a lot to cheer, and the stock will split 2-1 on Christmas Eve. A recently announced, four-year $12b share repurchase program is underway. Nike is growing strongly across all channels: retail (+13% comp sales), wholesale, and direct (online sales grew 49%). The only short-term negative for Nike is pockets of excess inventory in North America that will impact gross margin slightly relative to Street expectations in the upcoming quarter. Nike believes margins will hit new highs shortly thereafter.

It’s difficult to know what sort of macro takeaway to glean from these results. Nike’s outperformance, in all geographies, is consistent, and growing. Nike tells us that while the economy is difficult, it’s not so difficult that on trend companies/brands with a strong business cannot thrive. Moreover, the household sector within China appears healthy. On China:

Lastly, Greater China had another amazing quarter with revenue growth of 28%. The strength of the NIKE Brand is fueling strong consumer demand with futures up 34% in a marketplace that continues to be very healthy. We saw strong growth across nearly all categories in the quarter, led by sportswear, running and NIKE Basketball. We also saw continued strong growth from our own DTC business, up 51% in the quarter, fueled in part by our most successful Singles’ Day event ever.