Yum! Brands – Results Indicate Strong China Consumption Growth Continues

Yum! Brands (YUM) released results after the close of market yesterday. Yum is the world’s second largest quick service (fast food) restaurant after McDonald’s and operates the KFC, Taco Bell, Pizza Hut, Long John Silver, and A&W Restaurant franchises. Yum is an important company I follow because of the exceptionally strong gearing to China. This year, over 45% of the company operating profits will come from China. The positioning that Yum has in China is the result of decades of investment, brand building, and restaurant openings. There are 4,187 company-owned restaurant units in China amounting to over half of the company owned store base. Yum chooses to own the restaurants units, as opposed to franchise, because the restaurant profitability is so high. Yum makes more money on KFC and Pizza Hut units in China than they do in the US. The sales per restaurant and profit per restaurant are higher in China than the US which shows the incredible potential of China for strong global consumer brands. Yum franchises the vast majority of the units in the US and Europe which generates less profit of course but tremendous cash flows relative to a limited amount of capital. Yum has a wonderful business model and uses the free cash flow to steadily buy back shares, pay a dividend (2.3% yield) while China becomes a larger percentage of the total profit stream each year. The shares will likely bounce back quickly from any sell-off related to food inflation.

Yum! Brands (YUM) released results after the close of market yesterday. Yum is the world’s second largest quick service (fast food) restaurant after McDonald’s and operates the KFC, Taco Bell, Pizza Hut, Long John Silver, and A&W Restaurant franchises. Yum is an important company I follow because of the exceptionally strong gearing to China. This year, over 45% of the company operating profits will come from China. The positioning that Yum has in China is the result of decades of investment, brand building, and restaurant openings. There are 4,187 company-owned restaurant units in China amounting to over half of the company owned store base. Yum chooses to own the restaurants units, as opposed to franchise, because the restaurant profitability is so high. Yum makes more money on KFC and Pizza Hut units in China than they do in the US. The sales per restaurant and profit per restaurant are higher in China than the US which shows the incredible potential of China for strong global consumer brands. Yum franchises the vast majority of the units in the US and Europe which generates less profit of course but tremendous cash flows relative to a limited amount of capital. Yum has a wonderful business model and uses the free cash flow to steadily buy back shares, pay a dividend (2.3% yield) while China becomes a larger percentage of the total profit stream each year. The shares will likely bounce back quickly from any sell-off related to food inflation.

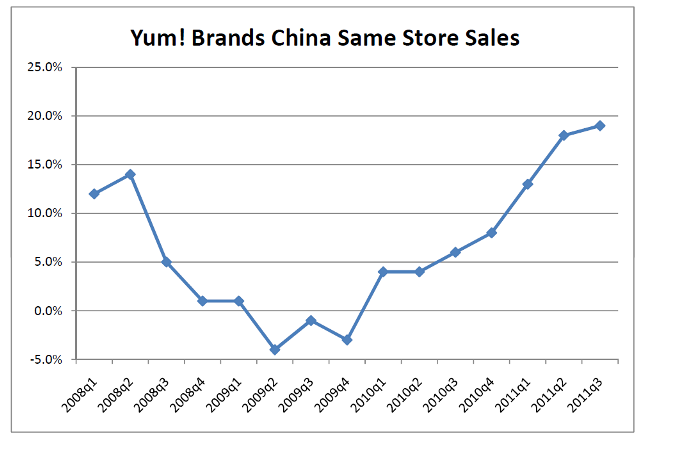

The operating profits in China were depressed as a result of high food inflation which transpired before any price increases fully took place. Yum announced price hikes at the end of the current quarter which should help profitability going forward. This will surely be discussed on the conference call which starts at 9:15 EST and is worth a listen. Aside from the input costs, the important macro take-away is that same store sales exceeded expectations and came in at +19% for restaurants open over a year. China same store sales were better than Wall Street expectations of +15%, stronger than last quarter’s +18%, and also the strongest since the company has been reporting this data.

Yum’s record China comps happened without the benefit of price hikes. The comps are likely to strengthen next quarter. A couple of weeks ago I wrote about Nike and how China order growth was the strongest result ever since Nike reported Asia/China as an operating segment. Again, there is no evidence of a hard landing in China, only fears of one.