Posts Tagged ‘unemployment’

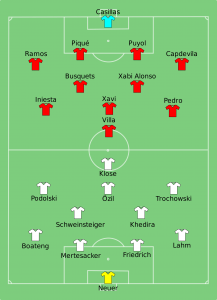

Spain & Germany – In Sickness and in Health

The plan forward with the Eurozone crisis is the German plan forward. Germany proposed closer fiscal union and increased austerity for EU-17 nations with high deficits and/or high debt burdens. This path suits German interests well because there is little that needs to be changed. Unfortunately from Spain’s standpoint, the German path forward is not…

Read MoreQue Lastima – Spain in a Vice as Interest Rates and Unemployment Soar

I’ve been writing about the impossibility of the ECB running appropriate monetary policy for 17 different nations. The dilemma couldn’t be more evident when contrasting the economy of Spain with the economy of Germany. Spain actually has less sovereign debt relative to GDP than does Germany. The problem for Spain isn’t the level of debt…

Read MoreMarket Confidence in Italy Hits New Lows – Berlusconi to Face New Rounds of Confidence Votes

Italian 10-YR bond yields hit 6.62% this morning, which marks a new high since concerns over the sustainability of European sovereign debt began to unfold. This wasn’t supposed to work this way after the Eurozone leaders announced a new structured investment vehicle to be put in place to leverage up the EFSF. It remains unclear…

Read MoreCharles Evans Dual Mandate Responsibilities Speech – Goes Too Far

Yesterday, Charles Evans who is the ninth president of the Federal Reserve Bank of Chicago and a voting member on the FOMC, gave a speech at the European Economics and Financial Center in London. This speech goes too far with starting to push the Fed towards more stimulus as the returns from additional stimulus diminish.…

Read More