Black Friday Retail Dud; Online Share Shift Accelerates

Bah humbug. Black Friday jumped the shark sometime around the turn of the century. Nonetheless, a disproportionate amount of retail and media focus continue to emphasize Black Friday’s importance as an event. While declining over several years, this year got markedly worse, to the point where media reports were forced to highlight the “normality” of shopping on Black Friday and the notable empty parking lots. This year, the Grinch brought store based retail sales over to online. Sources of information are disjointed but echo the same themes enough to draw some early conclusions:

Bah humbug. Black Friday jumped the shark sometime around the turn of the century. Nonetheless, a disproportionate amount of retail and media focus continue to emphasize Black Friday’s importance as an event. While declining over several years, this year got markedly worse, to the point where media reports were forced to highlight the “normality” of shopping on Black Friday and the notable empty parking lots. This year, the Grinch brought store based retail sales over to online. Sources of information are disjointed but echo the same themes enough to draw some early conclusions:

WSJ: “Early Sales Thin Black Friday Rush

“Driving up to a nearly empty parking lot at a Wal-Mart in Houston Friday morning, Dora Rodriquez, 39, stopped her silver hatchback in surprise and called out her window to another shopper: “Excuse me, the Black Friday sale – it’s ended already?”

Retail Metrics: forecasts a drop in November sales

“On Friday, Retail Metrics forecast a 0.9% drop in November sale-store sales for a handful of chains due to uninspiring store traffic.”

Bloomberg: Holiday Weekend Store Sales Seen Ailing as Shoppers Buy Online

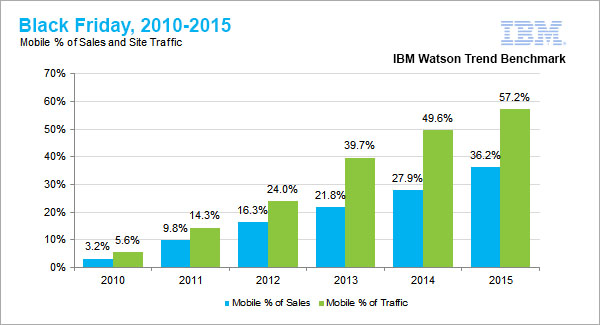

IBM Watson: Mobile wins over Black Friday shoppers

IBM highlights the explosive growth in mobile as a drivers of both sales and traffic:

The world is changing. While this change should not come as a surprise to the retail sector, it is still extremely problematic. Retail was conceptualized as an industry before the internet era, so business models with very high fixed costs (leases and labor) are not equipped to compete with online giants. Past capital investment focused on stores, not websites and speed of distribution network. The retail store losing its “destination status” turns the business model upside down. A number of observations on the potential for retail disasters in the 4th quarter:

- For several years, as Black Friday results waned, retail strategy focused on expanding the extravaganza, opening stores earlier, and earlier, and earlier on Friday morning. First to 4:00-5:00am, then midnight, and finally on Thanksgiving eve. The strategy is hopeless, simply spreading out shopping traffic over a longer time period, one which disrupts workers holiday plans and pays them double/triple time. Longer store hours won’t solve any problems for retail.

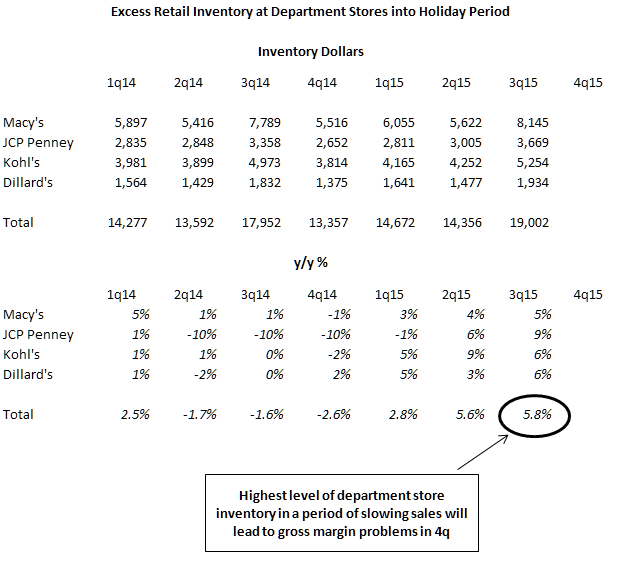

- Through the third quarter, retail inventory is “heavy” with high levels of inventory at all the major department stores. This bodes poorly for avoiding a markdown bloodbath in an environment where Black Friday traffic, and store based traffic continue to disappoint (see table below).

- Lastly, the weather is unseasonably mild at the exact wrong time for the retail sector. Frigid cold is needed to sell jackets, sweaters, and seasonal product. It will get cold eventually, but it may not be until after retailers panic with mark downs on excess inventory.

The holiday period is shaping up to be a brutal one, spelling trouble as full year profit forecasts are made/lost in the 4th quarter. Be wary of retail stock investments, the XRT bounced recently on hope from colder weather and short covering. The specialty retailers and department store operators within the XRT are as much market leaders as horse and buggy stocks. The retail sector generates plenty of cash, but the stocks will continue to de-rate as growth slows and more of the cash flow is used for catch-up technology investments.

Below a table of the excess inventory in the department store channel:

Markets are changing so how can the currency not follow suit, and the nature of spending not digitize. Good stuff.

Yes, to add to the comments above, in regard to a digitized economy, bitcoin, or at least the technology behind it could obsolete currency and along with it make banking and other transactions much more efficient. No more waiting for a check to clear because with bitcoin technology you know right away. No more involvement of a third part or the government in overseeing transactions. I would like to see CJF take on this subject. It’s meta, baby.

Will take a deeper look at Bitcoin at some point. There are regulatory and other issues for Bitcoin. It isn’t a topic I’ve been focused on – so do need to learn.