April employment report; strength broadens to lower-end

This month’s job report will rightly be questioned; late-winter/early spring weather for much of the country was horrible in February and March, and this morning’s report reflects payback from depressed activity making results appear better than they actually are. Nonetheless, trends in April, and thus far year-to-date, reflect a potentially important change in labor market dynamics; the broadening of job creation to the lower-end segment of the job market. This emerging trend represents the start of a sea-change towards “normalization” in the job market – looking more like what it used to look like pre-financial crisis, finally. The implications for lower/middle income consumption, the housing market, inflation, and corporate input costs are crucial.

This month’s job report will rightly be questioned; late-winter/early spring weather for much of the country was horrible in February and March, and this morning’s report reflects payback from depressed activity making results appear better than they actually are. Nonetheless, trends in April, and thus far year-to-date, reflect a potentially important change in labor market dynamics; the broadening of job creation to the lower-end segment of the job market. This emerging trend represents the start of a sea-change towards “normalization” in the job market – looking more like what it used to look like pre-financial crisis, finally. The implications for lower/middle income consumption, the housing market, inflation, and corporate input costs are crucial.

Data points supporting signs of broadening:

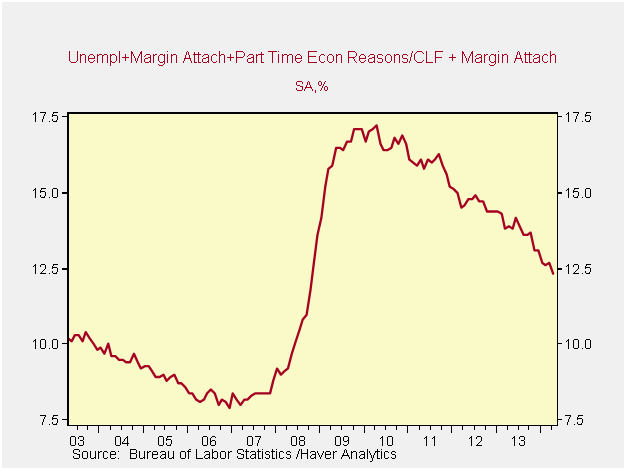

- U6 unemployment rate fell to 12.3% from 12.7% (this metric peaked at 17%). The U6 is the broadest measure of unemployment in the US, reflecting discouraged workers who are not looking for a job but have stated they want one, and people who are working part-time while they look for a full time position (part time for economic reasons).

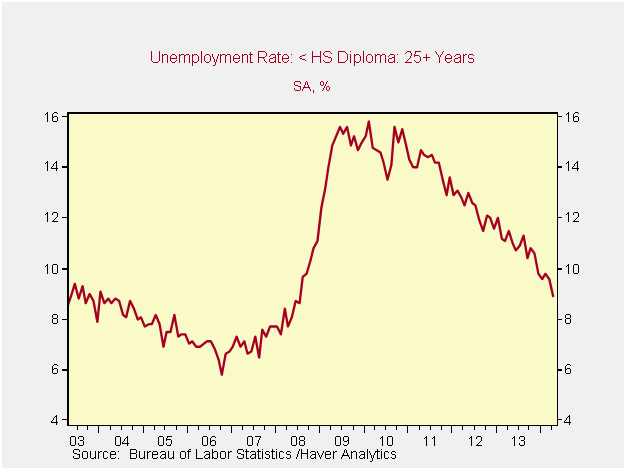

- Unemployment rate for high school drop outs, the least educated cohort of the labor force, fell by 70 bps from 9.6% to 8.9%.

- Teenage unemployment fell to a new cycle-low. Important heading into the summer period where teenage employment drives consumption in many segments.

- African American and Hispanic unemployment rates fell to new cycle lows.

- Federal income tax receipts (not released this morning) are up 15% this year through March. Data are sourced on a monthly basis from the US Treasury Department. Positive tax receipt data are a validating factor for job market strength.

The caveats – and reasons bears will dismiss the report:

- The Household Payroll report was negative 73k jobs. This measure is more volatile and had been much stronger in Jan-Mar relative to the headline job figures.

- Construction and retail segments drove outsized job growth of +32k and +35k respectively. These sectors are weather sensitive and may be unsustainably inflated.

- Employment-Population ratio didn’t change – remaining stable at 58.9%.

- Private workweek was stable at 33.7 hours. When the job market truly strengthens this metric should move higher.

- The net-birth adjustment created 234k jobs. Though this adjustment created about the same amount in April of last year.

CJF’s conclusions from the jobs report are unchanged. The US economy is in a slow, middling, recovery. This is actually the best case scenario for the stock market, a good, but not great, labor market. If (if emphasized because this isn’t the baseline view) the jobs report remains this strong (strengthens at this pace) it would be a good thing for the workers but a negative for the stock market – the end of the corporate input cost nirvana would negatively impact margins.

Some charts reflecting the broadening: