Crying Wolf – False Recession Calls Brutally Hurt Returns

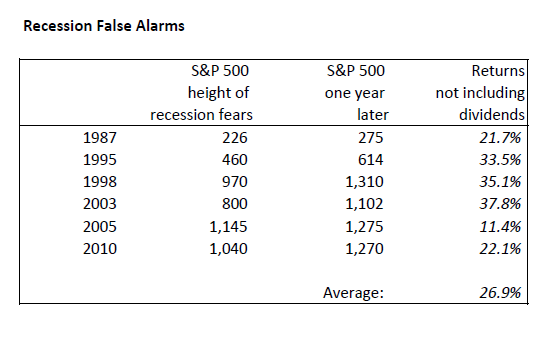

The ECRI has come out and caused a stir from continually touting their “unavoidable recession” forecast. In addition, ECRI co-founder, Lakshman Achuthan has been continually highlighting their 3/3 track record without forecasting a false positive. While this track record is impressive, Crackerjack Finance would like to highlight a term from our disclaimer; “past performance is no guarantee of future results”. At economic inflection points, the investment stakes are doubly heightened. I thought it worthwhile to review and quantify S&P 500 investment returns when investing in an environment of recession fears that does not materialize into a recession. Reviewing the numbers clearly demonstrates that if you are not invested during the time of a false recession fear you miss out on out-sized excess returns over the next 12 months. Of course if you are short during a period of recession fear that does not materialize the result can be devastating. Investors should expect to lose in the vicinity of 25% and then be put in the situation of having to revisit their investment stance in the subsequently closer to fair value market.

The ECRI has come out and caused a stir from continually touting their “unavoidable recession” forecast. In addition, ECRI co-founder, Lakshman Achuthan has been continually highlighting their 3/3 track record without forecasting a false positive. While this track record is impressive, Crackerjack Finance would like to highlight a term from our disclaimer; “past performance is no guarantee of future results”. At economic inflection points, the investment stakes are doubly heightened. I thought it worthwhile to review and quantify S&P 500 investment returns when investing in an environment of recession fears that does not materialize into a recession. Reviewing the numbers clearly demonstrates that if you are not invested during the time of a false recession fear you miss out on out-sized excess returns over the next 12 months. Of course if you are short during a period of recession fear that does not materialize the result can be devastating. Investors should expect to lose in the vicinity of 25% and then be put in the situation of having to revisit their investment stance in the subsequently closer to fair value market.

Although this blog had not yet been conceptualized during 2008-2009, I was 50% short heading into the financial crisis. I did so before the S&P 500 highs in 2008 and experienced some discomfort when the S&P rallied from 1,200 to 1,300 during the summer before the collapse. I was steadfast to stick with short positions because I was convinced that a recession was overdue, that risks were not being priced in, and that the crisis was related to solvency, not liquidity, and thus unavoidable. I apologize for tooting my own horn and to provide some balance I’ll immediately disclose that I got destroyed attempting to own “value stocks” during the tech boom and subsequent tech wreck of 2001. I learned a valuable lesson; that recessions and bear markets take all assets down and that unexpected events have a deluge of knock-on effects that negatively spiral (this prepared me for 2008).

Sorry for the tangent, but I point out my investment past because I want to make clear that I fully appreciate the value of capital preservation heading into a recession. The capital preserved during the bear market positions one to outperform in the subsequent recovery. Acknowledging this, the point of today’s writing is simply to demonstrate that the ax swings both ways during controversial times for the economy. Reducing some risk and waiting for a bit of clarity is a sensible strategy for many. If one is inclined to make a directional bet on the economy and the market it is very important to be right at junctures like now. I’m positioned to take advantage of a “false recession” scare that I believe is happening now. I’m hoping that the ECRI was premature in their call and has to admit going 3 for 4 six months from now.