Refinancing Activity Hits New Highs – Conditions now in Place for the Housing Market to Turn

Reports have recently been popping up that 30-year fixed mortgage rates in the US have approached 4%. This is a new low for the cycle. Much of the analysis I have read regarding mortgage rates is that they do not matter. The rational goes something like this: since mortgage rates have come down from the time of the financial crisis, and since housing activity and home prices haven’t picked up, mortgage rates don’t matter. The arguments go on to state that not enough people can refinance because of the broken and bogged down mortgage financing system in the US, and the issues with banks. I think this argument is wrong and that the housing market would be much worse than it is now with higher rates, therefore lower rates are making things “less bad”. Eventually they will start leading to market improvement. I believe that is set to begin happening next year.

Reports have recently been popping up that 30-year fixed mortgage rates in the US have approached 4%. This is a new low for the cycle. Much of the analysis I have read regarding mortgage rates is that they do not matter. The rational goes something like this: since mortgage rates have come down from the time of the financial crisis, and since housing activity and home prices haven’t picked up, mortgage rates don’t matter. The arguments go on to state that not enough people can refinance because of the broken and bogged down mortgage financing system in the US, and the issues with banks. I think this argument is wrong and that the housing market would be much worse than it is now with higher rates, therefore lower rates are making things “less bad”. Eventually they will start leading to market improvement. I believe that is set to begin happening next year.

There are two items which led to a collapse in the US housing market since 2006:

- House prices were too expensive

- Mortgage lending hit a mania which got too many households into an over-valued asset class

House prices being too expensive can be decomposed into a number of factors:

- The home price

- Mortgage rates

- Median Family Incomes

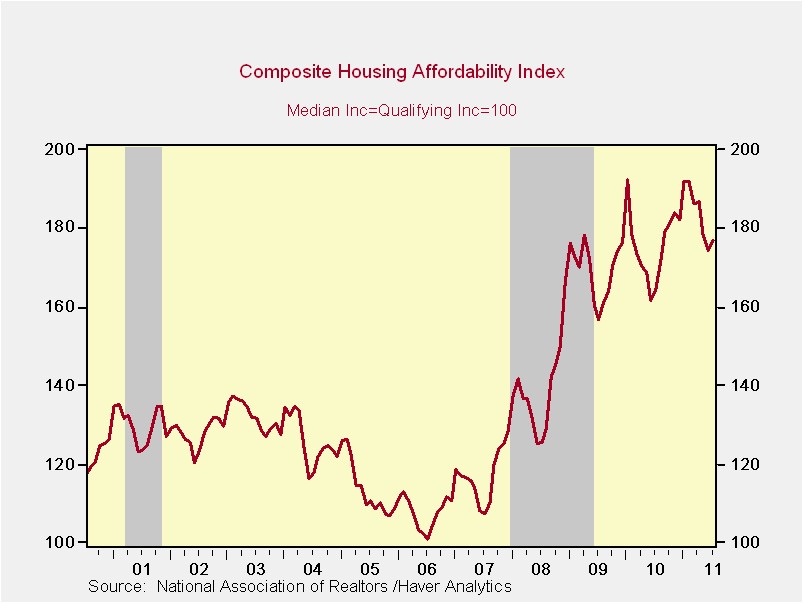

All three items have moved towards improving affordability over the past three years. The National Association of Realtors estimates that housing is now 77% more affordable than it was during the bubble peak in 2006. Here is a chart of housing affordability from NAR going back to that period (note that high numbers mean that housing is more affordable to new buyers):

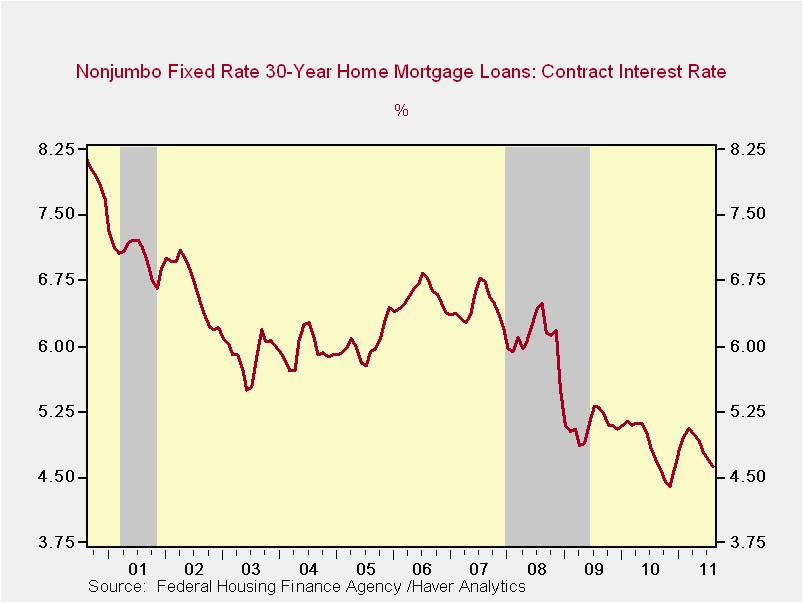

Here is a chart of mortgage rates for 30-year fixed rate mortgages. The final data for September are not available yet but reports indicate this will drop all the way to the low 4% range.

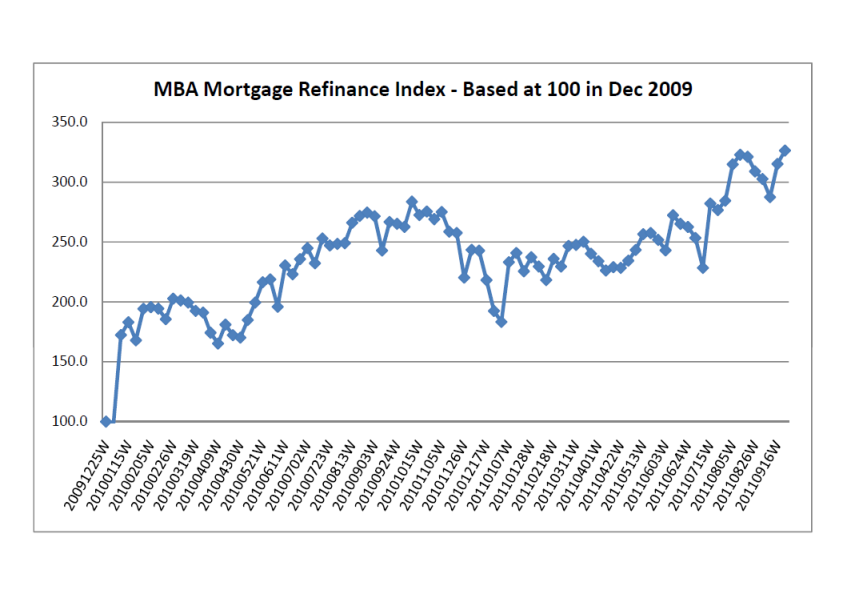

We all know that house prices have come down dramatically and incomes, while disappointing, have been going up tepidly in nominal terms. Getting back to the refinancing side of the equation, it is clear through the MBA refinancing data that refinancing activity is picking up. I created an index of activity back to year-end 2009 and we are at new cycle highs. Some are able to refinance their home.

There are two impacts from the pickup in this activity. The first, and most important, is the cash flow impact. Households are provided the opportunity to cut payments by some 15%-30%. Many households will re-term a 30-yr mortgage from 20, 22, 25 years back out to 30 years which further reduces monthly payments. In an environment where there is very limited net new job creation and limited scope for pay increases, this is quite meaningful to the average household. Obama has been pushing the HARP program to facilitate refinancing approval. I believe there is the potential for lower mortgage rates to impact the economy more than many economists expect.

There are two impacts from the pickup in this activity. The first, and most important, is the cash flow impact. Households are provided the opportunity to cut payments by some 15%-30%. Many households will re-term a 30-yr mortgage from 20, 22, 25 years back out to 30 years which further reduces monthly payments. In an environment where there is very limited net new job creation and limited scope for pay increases, this is quite meaningful to the average household. Obama has been pushing the HARP program to facilitate refinancing approval. I believe there is the potential for lower mortgage rates to impact the economy more than many economists expect.

The second impact is through improving the affordability of housing you increase the value of the housing stock. The wealth effect from housing will play out slowly and over many years. Moreover, even if lower mortgage rates simply get house prices flat, this is a very good thing from a household net worth standpoint relative to 3-4% declines which Case Schiller says we are running at today. Remember many households are leveraged to the value of their home, so 3% house price declines can mean anywhere from a 6%-30% hit to housing related equity (the nest egg).

To conclude, mortgage refinancing activity has picked up and the improvements in affordability will help clear the housing market in the future. Predicting when this will happen is an imprecise science but after a 6-year bear market, new lows in mortgage rates, and a 77% improvement in affordability the housing market is positioned to turn around sometime next year.