Posts Tagged ‘$SPY’

On the phase one China Trade Deal

In an unseemly signing ceremony, with a plethora of US CEOs and government officials, 3-4 dignitaries from China, and much bravado from President Trump, the Phase One US-China trade deal was signed and presented to the world. Markets cheered. Aside from the spectacle of it all, there is some cause for short-term optimism over a…

Read MoreThe Powell Put is Struck Lower

In spectacular fashion, over the past few weeks, stark reminders emerged on how fast confidence unravels in the midst of a slowdown, particularly so, when the slowdown is doused with policy response errors. A conflux of negatives compounded to send US financial markets into bear market territory, ultimately, calling into question the economic expansion since…

Read MoreOdd Market Swings Intra-day; Volatility Crush Over Multi-day

Earlier this month, April 5th was an odd day for financial markets. During market hours, it was interesting to behold one of the strongest single hours of the year, at the open, when the market rallied 20 handles on no real news of consequence. Sales could be seemingly filled at any price. One felt an…

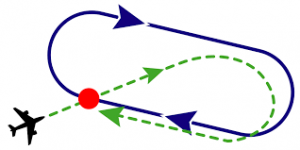

Read MoreHolding Pattern

The relentless grind higher in equity markets continues irrespective of periods of policy awkwardness, twitter rants, and republican in-fighting. Recent announcements that corporate tax reform isn’t likely until August/September didn’t faze the market at all. Clearly, the benefit of the doubt is being given to the Trump administration to make the American economy greater, and,…

Read More