Posts Tagged ‘S&P 500’

PTFI

Summarizing an investment mantra into an acronym is a common practice, and generally, a lazy short cut to sum things up. The investment themes for 2017 oscillated from technology/growth, to financials, to Trump tax trade, to retail, and now, to just being long whatever makes sense irrespective of the theme the idea falls under. It’s…

Read MoreOdd Market Swings Intra-day; Volatility Crush Over Multi-day

Earlier this month, April 5th was an odd day for financial markets. During market hours, it was interesting to behold one of the strongest single hours of the year, at the open, when the market rallied 20 handles on no real news of consequence. Sales could be seemingly filled at any price. One felt an…

Read MoreHolding Pattern

The relentless grind higher in equity markets continues irrespective of periods of policy awkwardness, twitter rants, and republican in-fighting. Recent announcements that corporate tax reform isn’t likely until August/September didn’t faze the market at all. Clearly, the benefit of the doubt is being given to the Trump administration to make the American economy greater, and,…

Read More2017

2016 started in a tailspin with spiraling China meltdown fears. Those fears proved to be ill-timed, and against most prognostications, despite BREXIT, the start of Fed rate hikes, and the looniest election anyone can remember with a shocker outcome, the market went on to have a gangbuster 2016, producing a total return of 12%. The…

Read MoreS&P2K; a new highs odyssey

Please excuse the summer lull – anticipating more regular posts after a well needed period of summer travel! Two posts ago (in late May) focused on the market ascent to 1,900. In relatively short order, another centennial milestone is surpassed with the market melt-up to 2,000 over the past 15 trading days. Recapping the market…

Read More1,900; now what?

The US stock market, the best market in the world for a multitude of reasons, hit new highs on Friday, ascending to the 1,900 level, on a closing basis. The market is confounding because of the lack of normal draw-down (no meaningful pull-backs in a long enough time to be scary) and because many high…

Read MoreDeja Déjà Vu – A Third Summer of European Crisis

Over the past week, it has become clear that a third annual conflagration throughout Europe is upon us. The crisis has morphed yet again, and like The Hydra, it has come back in a more menacing form. The issue this summer is more profound than the “sovereign debt crisis” which struck last summer. Last summer’s…

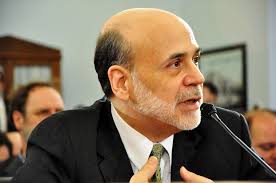

Read MoreBernanke’s Labor Market Speech – The Case for Continued Accommodative Policy

Ben Bernanke made a highly referenced speech earlier this week, credited with fueling a sharp rally in the stock market. The speech is colorfully titled: “Recent Developments in the Labor Market” and is a worthwhile read for investors and those interested in the US economy. The speech highlights a growing controversy in the labor market…

Read MoreInvestment Themes for Q4 Earnings Season

Fourth quarter earnings season is upon us while the market is off to a torrid start to the year. While the S&P 500 is up 4% year-to-date, there are a number of riskier indexes and sectors doing considerably better. The NASDAQ is up 6.3%, the Russell 2000 5.2%, the Hang Seng 7.6%, the Brazilian BOVESPA…

Read More2012 Global Investment Themes and Predictions

In 2011, the stock market experienced some dramatic swings, heightened volatility, managed some months of tremendous strength and sickening weakness. After an exhausting ride, the S&P 500 index returned to precisely where it started. For those who appreciate extreme precision, the market was down on the year based on the second decimal point of the…

Read MoreLack of Confidence – A Key Driver of Investment Returns in 2011 – An Opportunity and Risk for 2012

2011 has been a difficult year for most investors. Market sentiment oscillated throughout the year and generating returns has been exceedingly difficult to come by, let alone maintain. The world experienced at least three distinct crisis; Japanese nuclear disaster, Arab Spring, and Sovereign Debt contagion through Europe. All three of these events were enough to…

Read MoreISM New Orders – A Strong Indicator of GDP Growth Improved Sharply in November

The financial crisis in Europe detracts from a normal focus on the underlying strength of the US and global economy. Despite the US economy being relatively solid, an escalating Eurozone crisis has the potential to derail economic growth because of the enormity of the impact from a financial seizure. While the solution to the Eurozone liquidity…

Read MoreWalt Disney (DIS) Results Strong – Outside of Europe the Global Economy is Solid

Long live Mickey Mouse! Walt Disney reported strong results last night which reflected broad strength across the economy. Disney has diversified exposure to discretionary spending with its parks, media properties, and international businesses. A consistent theme through earnings season has been broadly solid corporate earnings and DIS is another example of this from a large…

Read MoreWhen Will the Market Start to be Forward Looking – Early Signals from Asia?

The markets have been through a period of wicked volatility with a significant pullback almost to the point of entering a new bear market. Intraday the S&P 500 was down 20% from its high but closed above those levels and went up from there. From the market’s closing bottom of 1,099 the S&P had a…

Read MoreA Guide for Q3 Earnings Season – What I’m Looking For

Earnings season officially gets started this week, with reports already released from Alcoa, Pepsi, JP Morgan and a few others. Tonight Google will be reporting after the close – a stock I continue to view favorably. Next week the reports will pour in and by the end of next week we’ll have a pretty good…

Read MoreCrying Wolf – False Recession Calls Brutally Hurt Returns

The ECRI has come out and caused a stir from continually touting their “unavoidable recession” forecast. In addition, ECRI co-founder, Lakshman Achuthan has been continually highlighting their 3/3 track record without forecasting a false positive. While this track record is impressive, Crackerjack Finance would like to highlight a term from our disclaimer; “past performance is…

Read MoreEurope’s Minimalist Approach Is the Wrong Course

What an 18 hours, as a conflux of negatives weigh on the market. In wrenching fashion, the US markets are down 6% since yesterday at 2:00pm. Most international markets around the world are down significantly more. Many emerging markets are off over 10% over two days. The Fed implemented Operation Twist yesterday, and the size…

Read More