Posts Tagged ‘Recession’

Redbook Chain Store Sales Remain Strong – Don’t Indicate Slowdown

There has been considerable airplay relating to the “near recessionary” levels of many economic indicators in August. Readings for consumer confidence, economic optimism, and Fed Surveys from Philadelphia, New York, and Richmond have all contracted. These items have led many economists and forecasters to predict a sharp downturn in ISM (released Thursday), and have led…

Read MoreChicago Fed Index – a “Not in Recession” data point

This morning, the Chicago Fed National Activity Index came out “better than expected” for the month of July. This measure is released with a bit of a lag and is one of the last July data points to be released. The measure is comprehensive and incorporates national activity relating to inflation, employment, consumption, and housing. So…

Read MoreIt’s Getting Real with the Recession Indicators

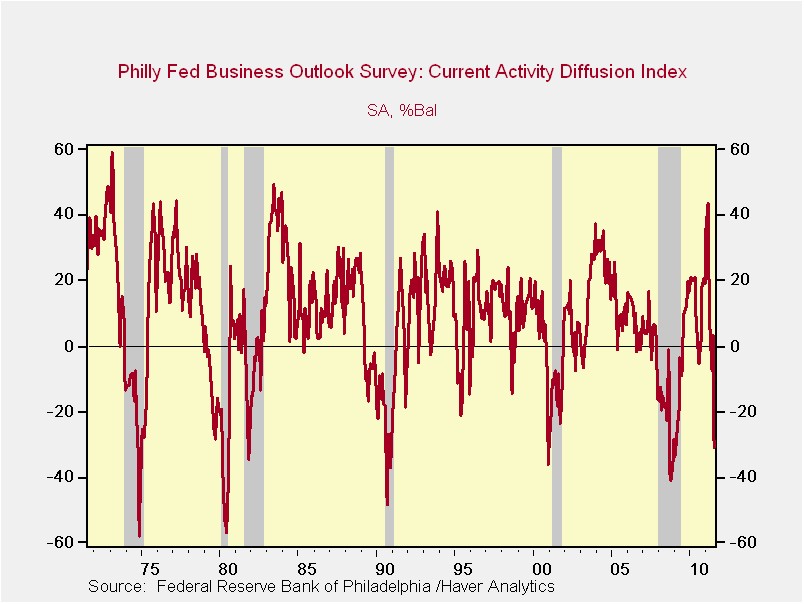

What is the Philadelphia Fed Index? Why has it exacerbated the market’s sharp declines from the morning? (see previous post) In short, the measure is an activity-based survey. It isn’t an actual measurement of anything, other than how people feel or sentiments on a given day. The survey-based results are indicating we are currently in…

Read MoreMorgan Stanley: “Dangerously Close to Recession”

Reasons for the weakness at the open: Morgan Stanley takes estimates from global GDP growth from 4.2% to 3.8% for 2011. Scary front page of the WSJ: “Fed Eyes European Banks” which is what they should be doing but it is still scary as presented. NTAP cut guidance last night and the stock is off…

Read MoreThe US Economy – not as bad as the headlines (7 reasons why)

While many pundits are talking about recessionary conditions – we would like to point out that the actual environment is much better than this, and in many regards, running at about the same pace now as Q1. We acknowledge that GDP growth has disappointed this year, and come in lower than bullish forecasts from Wall…

Read More“Recession Trade” – Clear by Investor Actions Today

The immediate observation for those watching this macabre sell-off is that stocks are pretty much being sold off based upon how they would be expected to hold-up in a recession, that will presumably be starting within the next 6-months or so. Any stocks that have a very high valuation, are particularly leveraged, are pro-cyclical…

Read MoreMarket Fears of a Recession in 2012

Well, the market clearly isn’t looking for the light at the end of the tunnel. Italian 10-YR bonds have surged, rallying 80 basis points (from a 6.09% yield on Friday to 5.29% yield today). Spanish 10-YR bonds have also surged, rallying 88 basis points (from a 6.03% yield on Friday to a 5.14% yield today).…

Read More