Posts Tagged ‘low volatility market’

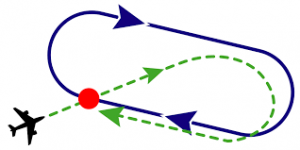

Holding Pattern

The relentless grind higher in equity markets continues irrespective of periods of policy awkwardness, twitter rants, and republican in-fighting. Recent announcements that corporate tax reform isn’t likely until August/September didn’t faze the market at all. Clearly, the benefit of the doubt is being given to the Trump administration to make the American economy greater, and,…

Read MoreComplacent Market; Fraught with Risk

In a shockingly flat stretch, noteworthy for the lack of volatility, and an incredibly tight range, the market has gone absolutely NOWHERE from July to October. 20-30 basis point moves feel outsized, even though they are not, in any sort of historical context. On days when the market goes up, the VIX falls to a…

Read More