Posts Tagged ‘labor market’

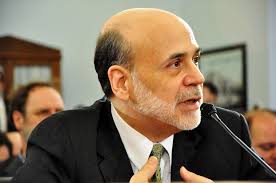

Bernanke’s Labor Market Speech – The Case for Continued Accommodative Policy

Ben Bernanke made a highly referenced speech earlier this week, credited with fueling a sharp rally in the stock market. The speech is colorfully titled: “Recent Developments in the Labor Market” and is a worthwhile read for investors and those interested in the US economy. The speech highlights a growing controversy in the labor market…

Read MoreLack of Confidence – A Key Driver of Investment Returns in 2011 – An Opportunity and Risk for 2012

2011 has been a difficult year for most investors. Market sentiment oscillated throughout the year and generating returns has been exceedingly difficult to come by, let alone maintain. The world experienced at least three distinct crisis; Japanese nuclear disaster, Arab Spring, and Sovereign Debt contagion through Europe. All three of these events were enough to…

Read MoreISM New Orders – A Strong Indicator of GDP Growth Improved Sharply in November

The financial crisis in Europe detracts from a normal focus on the underlying strength of the US and global economy. Despite the US economy being relatively solid, an escalating Eurozone crisis has the potential to derail economic growth because of the enormity of the impact from a financial seizure. While the solution to the Eurozone liquidity…

Read MoreStrong Labor Market Data Point – Unemployment Claims Solid Despite Department of Labor Explanation

In a curious press release, the Department of Labor came out this morning and highlighted some atypical calendar alignments for the unemployment claims data which make it more difficult for the government to adjust the not seasonally adjusted claims data for seasonal changes. As a result, the seasonally adjusted claims data fell by 37k to…

Read More