Posts Tagged ‘investing’

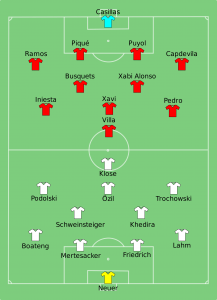

Spain & Germany – In Sickness and in Health

The plan forward with the Eurozone crisis is the German plan forward. Germany proposed closer fiscal union and increased austerity for EU-17 nations with high deficits and/or high debt burdens. This path suits German interests well because there is little that needs to be changed. Unfortunately from Spain’s standpoint, the German path forward is not…

Read MoreInvesting Ahead of a European Recession

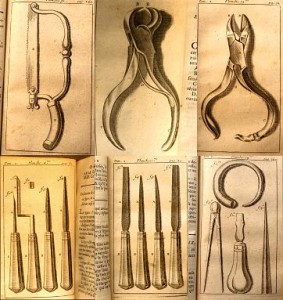

Investing ahead of a recession is like a trip to the dentist for a filling when the Novocain isn’t quite right. You know you are in for some pain, but it’s unclear just how much, and how long it will last. Europe is accepting the German path forward, which will at a minimum, lead to…

Read MoreWhen Will the Market Start to be Forward Looking – Early Signals from Asia?

The markets have been through a period of wicked volatility with a significant pullback almost to the point of entering a new bear market. Intraday the S&P 500 was down 20% from its high but closed above those levels and went up from there. From the market’s closing bottom of 1,099 the S&P had a…

Read MoreObama’s American Jobs Act Speech – Implications for Markets

The S&P 500 futures were about unchanged heading into his speech and at last glance they were down 3 points – but this may be due to the 9/11 anniversary terror threat announcement more so than anything said in the speech. I come away moderately encouraged by Obama’s speech tonight. He stated at the outset…

Read MoreInvesting In Europe – Now the Risk/Reward Is Attractive

Yesterday, I reviewed the reasons why the Eurozone as a monetary union is a flawed construct and why the implications for a breakup are disastrous. I believe this is so much the case, that the odds of a Eurozone unwind are actually quite low. The breakup option is really the self-immolation option as all parties…

Read MoreChanel, Gaspard Ulliel, Scorsese, and The Rolling Stones: The Awesome Power of Global Brands

One theme I have been highlighting is the value that exists in the developed European corporate sector which of course gets ignored as fears of a crisis escalate. Chanel having the ability to get Martin Scorsese to direct an advertisement with French actor, Gaspard Ulliel, with vintage Rolling Stones (“She Said Yeah – December’s Children…

Read MoreIt’s Time to Buy in Hong Kong

After a brutal correction in both prices and valuations it is time to get long(er) China geared Hong Kong listed equities. I believe the timing is right because the single largest risk factor, inflationary pressure, is in the process of peaking, and is likely to abate moving forward. China growth persists at a 9% clip…

Read More