Posts Tagged ‘globalization’

The widow maker trade spreads from Japan to the US

Since 1990, one trade that has always lost money, over any reasonable time period, has been the shorting of JGBs (Japanese 10-year). This trade, unique in its consistency, developed its own name; “the widow maker”. With JGBs yielding 57 bps today, the widow maker is alive and kicking. Over the past 24-year time period, JGB…

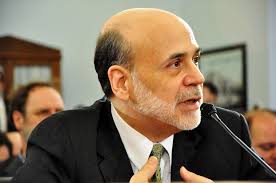

Read MoreBernanke’s Labor Market Speech – The Case for Continued Accommodative Policy

Ben Bernanke made a highly referenced speech earlier this week, credited with fueling a sharp rally in the stock market. The speech is colorfully titled: “Recent Developments in the Labor Market” and is a worthwhile read for investors and those interested in the US economy. The speech highlights a growing controversy in the labor market…

Read More