Posts Tagged ‘Federal Reserve Board’

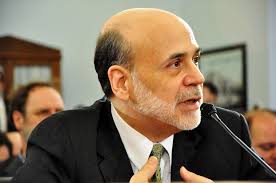

Bernanke’s Labor Market Speech – The Case for Continued Accommodative Policy

Ben Bernanke made a highly referenced speech earlier this week, credited with fueling a sharp rally in the stock market. The speech is colorfully titled: “Recent Developments in the Labor Market” and is a worthwhile read for investors and those interested in the US economy. The speech highlights a growing controversy in the labor market…

Read MoreThe Rest of Europe Can’t be German

The EU Summit and ECB meeting which transpired last week are likely to be the final supporting actions by Eurozone officials this year. The tack forward for Europe has been clarified; move ahead with the long and arduous process of fiscal unification, supported by a reactive ECB. The path ensures two outcomes; that there will…

Read MoreQue Lastima – Spain in a Vice as Interest Rates and Unemployment Soar

I’ve been writing about the impossibility of the ECB running appropriate monetary policy for 17 different nations. The dilemma couldn’t be more evident when contrasting the economy of Spain with the economy of Germany. Spain actually has less sovereign debt relative to GDP than does Germany. The problem for Spain isn’t the level of debt…

Read MoreEurope’s Crisis Spreads as Spain, Belgium, France, the Euro and EU-17 get Questioned – How Does It End?

For a number of months, the financial crisis in Europe has been explained under the guise of sound versus unsound policy. If this were indeed the case, the fix would be simple; eliminate unsound and unsustainable policy and voila, the problems would just go away. European leaders have shifted blame continuously from one problem to…

Read MoreAnalysis of the Fed Minutes – Dovish Tone Remains

The Fed minutes released today at 2:00pm didn’t provide anything that was too much of a surprise. The general impression I felt after reading the 12 pages was that the Fed remains exceptionally dovish. Economic growth, while not rolling-over, remains disappointing, so the Fed is looking to remain accommodative. Inflation was discussed in dovish terms.…

Read More