Posts Tagged ‘economics’

The Economic Process of Deleveraging Part Two – Why the US is Well Positioned

The differences between the US situation post-financial crisis and Japan in 1990 are stark. The previous post outlined how extreme things got in Japan and how ahead of itself the Japanese stock market, real estate market and economy got. While Japan was exposed to “extreme extremes” the US economy experienced imbalances that could be worked…

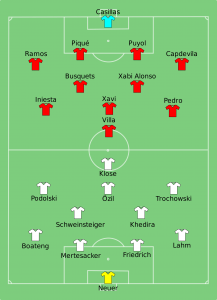

Read MoreSpain & Germany – In Sickness and in Health

The plan forward with the Eurozone crisis is the German plan forward. Germany proposed closer fiscal union and increased austerity for EU-17 nations with high deficits and/or high debt burdens. This path suits German interests well because there is little that needs to be changed. Unfortunately from Spain’s standpoint, the German path forward is not…

Read MoreHere’s how it’s different this time

How is 2011 different than 2008? As the financial press quotes “investment professionals” each and every morning on the front page of the WSJ or the TOP bloomberg story with mention of how dire the market and economic situation is, and how there are many similarities to the feel of 2008 – I thought it…

Read More