Posts Tagged ‘Brexit’

Turkey Day Highs

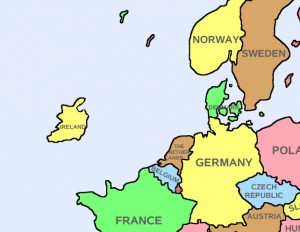

The bull market is set to turn 9 in 2017. Vanquished by the bull: Eurozone crisis, deflation, China bubbles, taper tantrums, BREXIT, and now Trump. The bullishness of the tape continues to shock, with the Trump rally, after the fact, looking strikingly similar to the BREXIT rally; the market provides every indication that one outcome…

Read MorePounded; BREXIT Risks Hit Markets

In a low volatility, range bound market, it doesn’t take much to cause a break. Rising global bonds yields are a major concern that double-impact the market; higher future business costs of funding growth, financing acquisitions, and implementing share repurchases, while, in tandem, high equity valuations are pressured. Now the market has another major worry.…

Read MoreOn Brexit

What a tumultuous 5 days. The lurching feeling is all the more acute after a period of one-way markets (up) and declining volatility. With polls shifting towards “Remain” last week, the prospect of all-time highs in the S&P 500 held an aura of inevitability. The unexpected Brexit vote, by a solid 4 point margin, tanked…

Read More