Economics

Analysis of the Fed Minutes – Dovish Tone Remains

The Fed minutes released today at 2:00pm didn’t provide anything that was too much of a surprise. The general impression I felt after reading the 12 pages was that the Fed remains exceptionally dovish. Economic growth, while not rolling-over, remains disappointing, so the Fed is looking to remain accommodative. Inflation was discussed in dovish terms.…

Read MoreUS Economy Demonstrates Resiliency – Retailer Comp Sales Strengthen in September

Despite massive uncertainty stemming from the manner in which Europe is handling its financial crisis, a gut wrenching stock market sell-off (the S&P 500 was down 7.2% last month), negative headlines almost every day, and predictions towards the end of the month that the US economy is now “in a recession”, the US consumer continues…

Read MoreExcesses Cause Recession – A Comparison of 2008 and 2011

Recessions are typically caused by some sort of an excess. Real economic activity stretches too far and the subsequent unwind causes a retrenchment via a sudden and abrupt change in business and household behavior. There have been a number of excesses that have built up in the global economy over the past couple of decades.…

Read MoreStrong Labor Market Data Point – Unemployment Claims Solid Despite Department of Labor Explanation

In a curious press release, the Department of Labor came out this morning and highlighted some atypical calendar alignments for the unemployment claims data which make it more difficult for the government to adjust the not seasonally adjusted claims data for seasonal changes. As a result, the seasonally adjusted claims data fell by 37k to…

Read MoreRefinancing Activity Hits New Highs – Conditions now in Place for the Housing Market to Turn

Reports have recently been popping up that 30-year fixed mortgage rates in the US have approached 4%. This is a new low for the cycle. Much of the analysis I have read regarding mortgage rates is that they do not matter. The rational goes something like this: since mortgage rates have come down from the…

Read MoreOperation Twist – What the Fed May Announce Today and the Implications

The Federal Reserve is likely to announce additional easing measures at the conclusion of the two-day Fed meeting today. Additional easing is anticipated by the market but there are a number of uncertainties related to the scope of what the Fed will implement. The most focused on initiative is called “Operation Twist” which is jargon…

Read MoreFlow of Funds Household Net Worth – US Making Progress

On Friday, the Federal Reserve Board released the quarterly Flow of Funds data which measure the US household sector’s assets, liabilities, and net worth. The data are released with a lag as we just received Q2 measurements, two and a half months after the calendar quarter came to a close. While the level of net…

Read MoreCharles Evans Dual Mandate Responsibilities Speech – Goes Too Far

Yesterday, Charles Evans who is the ninth president of the Federal Reserve Bank of Chicago and a voting member on the FOMC, gave a speech at the European Economics and Financial Center in London. This speech goes too far with starting to push the Fed towards more stimulus as the returns from additional stimulus diminish.…

Read MoreEurozone Breakup – Implications for Financial Markets are Disastrous

Over Labor Day weekend we saw an unfortunate breakdown in Europe’s approach, strategy, and near-term ability to avoid a financial crisis. In the Mecklenburg Western Pomerian state (along the coast of the Baltic Sea), Germans voted against the Christian Democratic Union which is a repudiation of Angela Merkel’s support and commitment to the Eurozone. I’ll…

Read MoreWhy Can’t We Create Jobs?

I’ve been holding a constructive view on the economy and markets for a number of reasons. The economy isn’t as soft as has been presented and market valuations are extremely low for a non-recessionary environment (if that is indeed the environment we are in). Today’s Employment Report was downright ugly. Being constructive, I could search…

Read MoreRedbook Chain Store Sales Remain Strong – Don’t Indicate Slowdown

There has been considerable airplay relating to the “near recessionary” levels of many economic indicators in August. Readings for consumer confidence, economic optimism, and Fed Surveys from Philadelphia, New York, and Richmond have all contracted. These items have led many economists and forecasters to predict a sharp downturn in ISM (released Thursday), and have led…

Read MoreBen Bernanke’s Jackson Hole Speech: A Step In The Right Direction

I just read Ben Bernanke’s speech at Jackson Hole, and think it is one of the better speeches he has done in some time. I read some acknowledgement that there is little more the Fed can actually do to improve the US economy. This is of course true. Bernanke realizes he can only create an…

Read MoreBernanke’s Jackson Hole Speech: Market Could Close at 1,100 or 1,200 Today

The market remains destabilized which is quantified by the VIX index stubbornly remaining in the 40 vicinity. As long as the VIX remains in the 30-40 range investor should expect to see 2-3% moves both up and down in the market from these levels. I believe that the propensity for violent up moves is as…

Read MoreOhayou Gozaimasu! Moody’s Downgrades Japan

Moody’s came out today and downgraded Japan’s Sovereign Credit Rating from Aa2 to Aa3 based on the size of its deficit and large buildup of government debt. As a result of this downgrade, a number of Japanese banks and insurance companies will be downgraded by Moody’s as well. This news will make much less of…

Read MoreChicago Fed Index – a “Not in Recession” data point

This morning, the Chicago Fed National Activity Index came out “better than expected” for the month of July. This measure is released with a bit of a lag and is one of the last July data points to be released. The measure is comprehensive and incorporates national activity relating to inflation, employment, consumption, and housing. So…

Read MoreHere’s how it’s different this time

How is 2011 different than 2008? As the financial press quotes “investment professionals” each and every morning on the front page of the WSJ or the TOP bloomberg story with mention of how dire the market and economic situation is, and how there are many similarities to the feel of 2008 – I thought it…

Read MoreIt’s Getting Real with the Recession Indicators

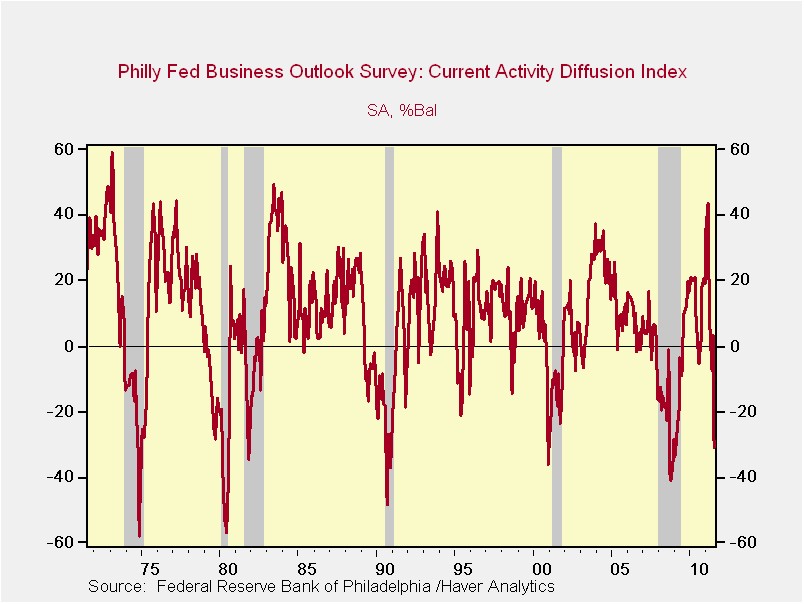

What is the Philadelphia Fed Index? Why has it exacerbated the market’s sharp declines from the morning? (see previous post) In short, the measure is an activity-based survey. It isn’t an actual measurement of anything, other than how people feel or sentiments on a given day. The survey-based results are indicating we are currently in…

Read More